The Quant Scientist Algorithmic Trading System 2.0 – Includes Verified Content:

The Quant Scientist Algorithmic Trading System 2.0 – Free Download Video Sample:

PNJ Sample – The Quant Scientist Algorithmic Trading System 2.0, watch here:

Review of The Quant Scientist Algorithmic Trading System 2.0

In the fast-changing world of modern finance, algorithmic trading has become a critical skill for traders looking to outperform the competition. The Quant Scientist Algorithmic Trading System 2.0 is an advanced learning program tailored to teach traders how to build, test, and fine-tune algorithmic strategies. Priced at $2,499, this all-inclusive course blends theory with real-world application to prepare students for a data-centric trading environment.

This review explores the system’s core offerings, including its methodical teaching approach, programming content, integration of machine learning, and the iterative processes used to refine trading systems. Readers will gain valuable insight into how effective this program is and whether it’s worth the investment.

Key Features of the Algorithmic Trading System

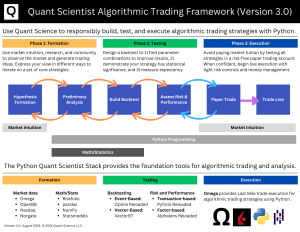

At the core of The Quant Scientist Algorithmic Trading System 2.0 is its clearly defined learning path. The program is divided into six essential stages:

-

Strategy Formation

-

Preliminary Analysis

-

Backtesting

-

Risk and Reward Assessment

-

Paper Trading

-

Live Trading

Strategy Formation

The program begins with strategy creation, encouraging learners to craft original trading concepts. This creative stage challenges participants to draw on market knowledge and generate approaches tailored to their style. This step fosters innovation, helping traders develop distinctive strategies in an oversaturated market.

Preliminary Analysis

After conceptualizing a strategy, students transition to the analysis phase using Python. With this powerful language, learners collect and manage key market data to analyze their strategy ideas. Gaining proficiency in Python is fundamental to understanding market behavior and supports the accuracy of subsequent processes.

Backtesting

The backtesting segment evaluates the robustness of developed strategies. However, the course advises against brute-force optimization due to the risk of overfitting. Instead, emphasis is placed on refining parameters such as stop-loss settings and entry points. This focused methodology helps build strategies that can hold up in real market conditions.

Risk and Reward Assessment

In this phase, students use key metrics like drawdown, Sharpe ratio, and CVaR to assess risk and potential reward. Understanding these indicators is vital to determining whether a strategy is viable for real-world trading. These KPIs allow participants to forecast how their strategies might behave across various market conditions.

Paper Trading

Before going live, participants put their strategies through paper trading—simulating trades without using actual funds. This allows for hands-on practice and further validation of the system’s performance. This risk-free phase is essential for strategy refinement and confidence building.

Live Trading

The final step is real-time trading. Here, students learn to adapt strategies dynamically, responding to market fluctuations with agility. The course underscores the importance of continual monitoring and revision to optimize trading outcomes in a live environment.

Educational Framework and Tools

The Quant Scientist Algorithmic Trading System 2.0 provides more than just step-by-step guidance; it delivers a robust academic foundation. Learners grow their Python coding capabilities and explore real-world applications of machine learning in trading. These tools empower traders to interpret and utilize large-scale data efficiently.

Programming and Machine Learning

A core element of the program is its commitment to Python for financial analysis. Python’s widespread use in fintech makes it an ideal tool for this course. Beyond coding, the course delves into machine learning to help traders create adaptive, intelligent systems based on historical and real-time data.

Machine learning offers significant value in modern trading, allowing traders to optimize strategies automatically. This synergy of data science and algorithmic development positions the program as a forward-thinking solution.

Cost and Investment Value

At $2,499, this course may seem like a substantial commitment, but its comprehensive scope justifies the price for serious traders. Analyzing the cost in relation to what’s taught reveals its strong value proposition.

Cost Breakdown

| Component | Cost |

|---|---|

| Python Programming Course | $999 |

| Machine Learning Application | $799 |

| Backtesting Techniques | $699 |

| Risk Assessment Strategies | Included |

| Paper Trading & Live Trading | Included |

This pricing breakdown showcases the range of high-value skills offered. The course provides a return on investment not only in trading performance but also in long-term skill development. Collaborative learning also enhances the experience, creating a richer knowledge-sharing environment.

Comparing with Other Trading Programs

Before enrolling, it’s wise to compare The Quant Scientist Algorithmic Trading System 2.0 with other similar offerings. Key differentiators include course structure, content depth, and advanced features like machine learning integration.

| Feature | The Quant Scientist | Alternative Program A | Alternative Program B |

|---|---|---|---|

| Price | $2,499 | $1,999 | $3,000 |

| Structured Learning | Yes | No | Yes |

| Focus on Python | Yes | Limited | Limited |

| Machine Learning | Yes | No | Yes |

| Live Trading Component | Yes | Yes | No |

This comparison highlights how The Quant Scientist’s course excels in structure and technology-driven instruction. The use of machine learning and a focus on live trading set it apart in a crowded market.

Conclusion

The Quant Scientist Algorithmic Trading System 2.0 delivers a well-rounded education for both beginners and experienced traders aiming to strengthen their algorithmic skills. Its clear learning framework, combined with practical exposure and cutting-edge tools like machine learning, provides a comprehensive training ground.

For those considering an investment in their trading education, this course offers a strong blend of theory, application, and innovation—making it a smart choice for traders ready to evolve in an algorithm-driven trading world.