Free Download Wyckoff simplified from Michael Z

Check content proof, now:

Description

This is a focused, in-depth course designed for those who want to either begin learning or take their understanding of the Wyckoff Method to the next level.

Each video lesson—typically around 30 minutes in length (some longer)—provides clear, visual examples of key Wyckoff principles in action.

The main goal of the course is to demonstrate real-time market setups using charts that clearly illustrate Wyckoff concepts and actionable trade edges.

Key Topics Covered:

-

Trading Ranges – Identifying and interpreting consolidation phases.

-

Distribution & Accumulation – Recognizing selling tails, buying tails, and the market phases they signal.

-

LPS & LPSY – Understanding the Last Point of Support and Last Point of Supply and how to trade around them.

-

Trade Entry Zones – Pinpointing optimal entry/exit points—and areas to avoid entirely.

-

Springboards & Reverse Springboards – Spotting setups that signal breakouts or breakdowns.

-

Effort vs. Result – A core Wyckoff principle for assessing trade entries and exits based on volume and price behavior.

-

Trend Shifts – Learning how to identify a trend change or a shift in behavior before the crowd.

-

Risk Management – Essential techniques to protect capital and manage position sizes.

-

Reverse Trend Lines – How to draw them correctly and why they matter.

-

The Wyckoff Lens of a Floor Trader – See market behavior through the experience of a professional floor trader.

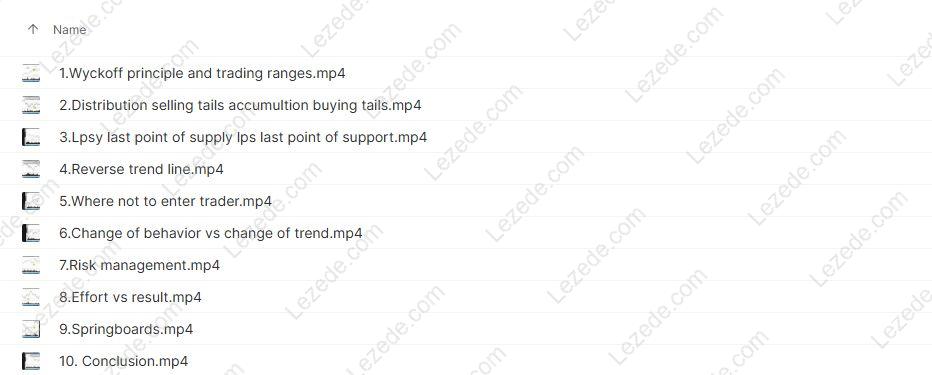

Content Proof

-

Wyckoff Principle and Trading Ranges

-

Distribution, Selling Tails, Accumulation, Buying Tails

-

LPSY (Last Point of Supply) & LPS (Last Point of Support)

-

Reverse Trend Line

-

Where NOT to Enter a Trade

-

Change of Behavior vs. Change of Trend

-

Risk Management

-

Effort vs. Result

-

Springboards

-

Conclusion