Free Download The Wheel Strategy With Options by Dan Sheridan

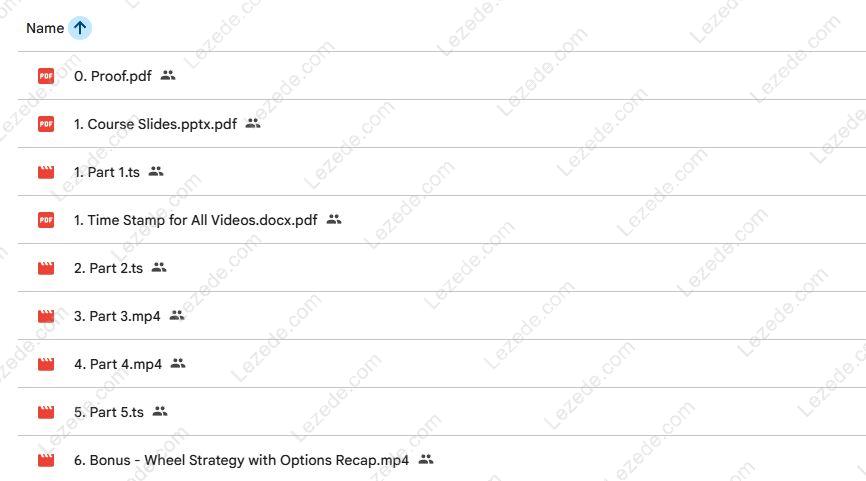

Check content proof, now:

Download The Wheel Strategy With Option, see what’s included in this course:

The Wheel Strategy With Option Free PDF Sample:

Lesson Series: The Wheel Strategy With Options – Introducing the All Options Wheel

We’re excited to launch “The All Options Wheel Strategy”—a modern, more accessible take on the classic Wheel Strategy, tailored for today’s traders seeking higher yield potential with reduced capital requirements.

While the traditional Wheel Strategy involves selling cash-secured puts and, if assigned, holding long stock to then sell covered calls, this method can be prohibitively expensive for smaller accounts. One of the key limitations of the conventional approach is that it requires a substantial amount of capital to buy and hold stock, which often leads to modest percentage returns relative to the capital at risk.

Recognizing these limitations, this lesson series introduces a powerful alternative: The All Options Wheel Strategy. This revamped version maintains the core principles of the Wheel but replaces its capital-heavy components with more efficient options-based structures—allowing for improved yield potential and broader accessibility.

The All Options Wheel differs in two major ways:

-

Short Puts → Put Credit Spreads

Instead of selling fully cash-secured puts, this strategy utilizes put credit spreads—a significantly less capital-intensive way to express bullish sentiment, while still generating premium income and managing defined risk. -

Long Stock → In-the-Money Long Calls

Rather than purchasing shares outright (as in the traditional Wheel), this approach uses deep in-the-money call options as a stock surrogate. This substitution reduces capital outlay while preserving directional exposure and flexibility.

Throughout the series, you’ll learn how to structure, execute, and manage each leg of the All Options Wheel Strategy—from initial setup to adjustment techniques and profit-taking rules. This approach is ideal for traders with small to medium-sized accounts who want to maximize return on capital, improve risk/reward ratios, and maintain a high level of strategic control.

Whether you’re new to the Wheel or looking to upgrade your current strategy, this lesson series offers a practical, step-by-step roadmap to mastering an innovative, all-options-based income strategy.

Includes over 3 hours of content and downloadable PDF slides.

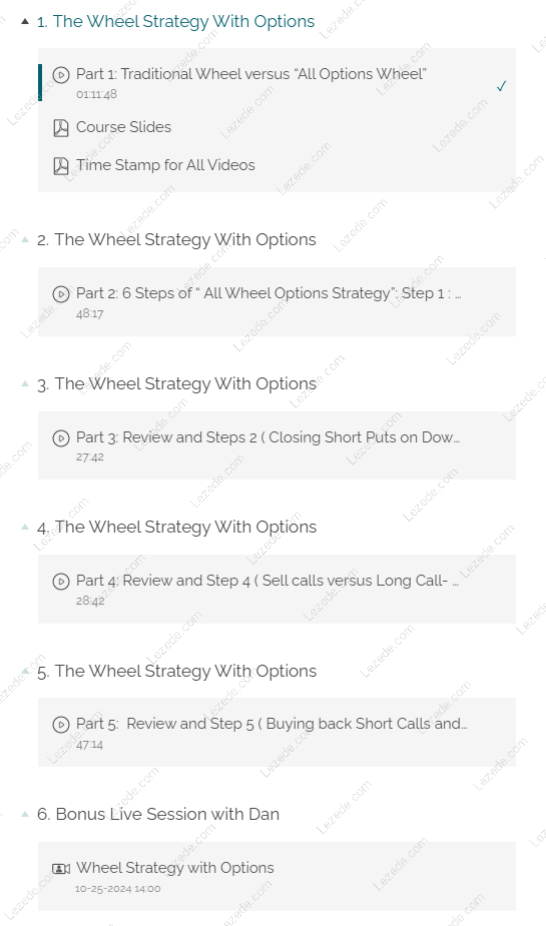

Course Lessons

01 The Wheel Strategy With Options

- Part 1: Traditional Wheel versus “All Options Wheel”

- Course Slides

- Time Stamp for All Videos

02 The Wheel Strategy With Options

- Part 2: 6 Steps of “ All Wheel Options Strategy”: Step 1 : Sell Put Credit Spreads

03 The Wheel Strategy With Options

- Part 3: Review and Steps 2 ( Closing Short Puts on Downside) and Step3 ( Buy an In-the-Money Call)

04 The Wheel Strategy With Options

- Part 4: Review and Step 4 ( Sell calls versus Long Call- DiagonalStrategy). If more Bullish in Step 4- Can also Sell Put Credit Spread)

05 The Wheel Strategy With Options

- Part 5: Review and Step 5 ( Buying back Short Calls and Selling out LongITM Calls- Closing your Long Diagonal, essentially finishing the Wheel).Step 6 is merely starting the entire Process over again.

06 Bonus Live Session with Dan

- Wheel Strategy with Options