Free Download Split Strike Calendars in a Volatile Market by Dan Sheridan

Check content proof, now:

Download Split Strike Calendars in a Volatile Market, see what’s included in this course:

Lesson Series: Split Strike Calendars in a Volatile Market – By Dan Sheridan

“Split Strike Calendars in a Volatile Market,” developed and taught by veteran options trader Dan Sheridan, presents a sophisticated strategy that leverages both long and short options to generate consistent returns in unpredictable market environments. This approach is specifically designed to help traders benefit from heightened volatility while maintaining a disciplined risk management framework.

The strategy revolves around constructing calendar spreads—which involve selling near-term options and buying longer-term options at the same strike or different strikes (hence the “split strike” variation). By adjusting the strikes and expirations, traders can fine-tune their exposure to volatility and time decay. The flexibility of this setup makes it particularly useful in choppy or fast-moving markets where traditional directional trades may struggle.

Dan Sheridan’s methodology emphasizes risk-controlled income generation, teaching traders how to structure the trade, monitor it under varying market conditions, and adjust it as needed to protect capital and enhance returns. Whether you’re a conservative trader looking to minimize drawdowns or an active income trader seeking to capitalize on volatility spikes, this lesson series provides actionable insights and real-time trade examples to support your success.

Ideal for intermediate to advanced options traders, this strategy is a powerful addition to any volatility-based trading toolkit.

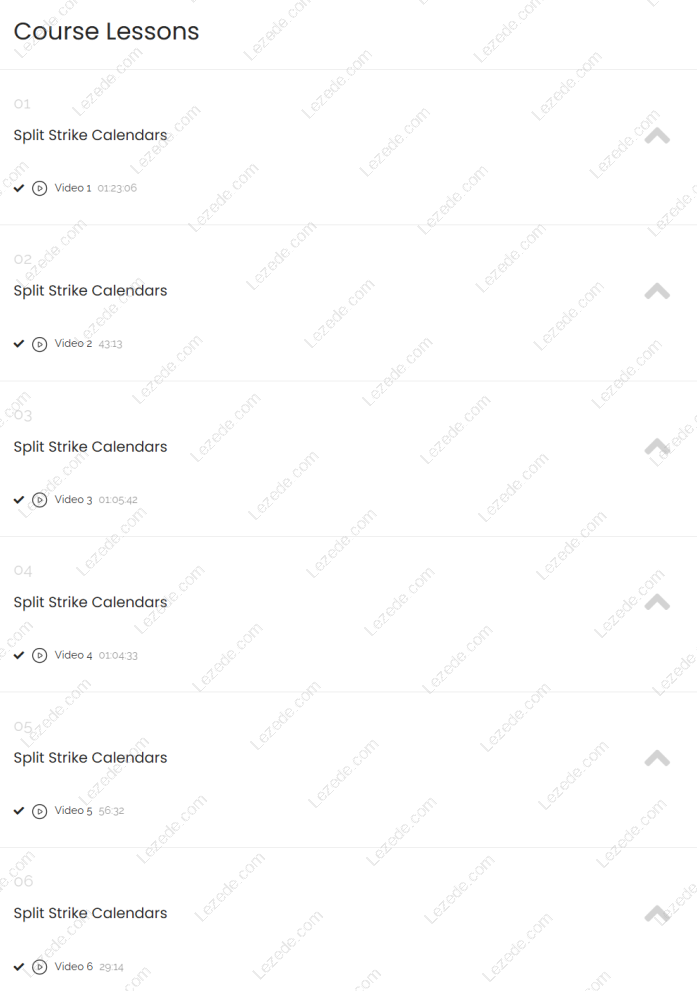

Course Lessons

01 Split Strike Calendars

- Video 1

02 Split Strike Calendars

- Video 2

03 Split Strike Calendars

- Video 3

04 Split Strike Calendars

- Video 4

05 Split Strike Calendars

- Video 5

06 Split Strike Calendars

- Video 6