Free Download Footprint Deep Dive by MarketDelta

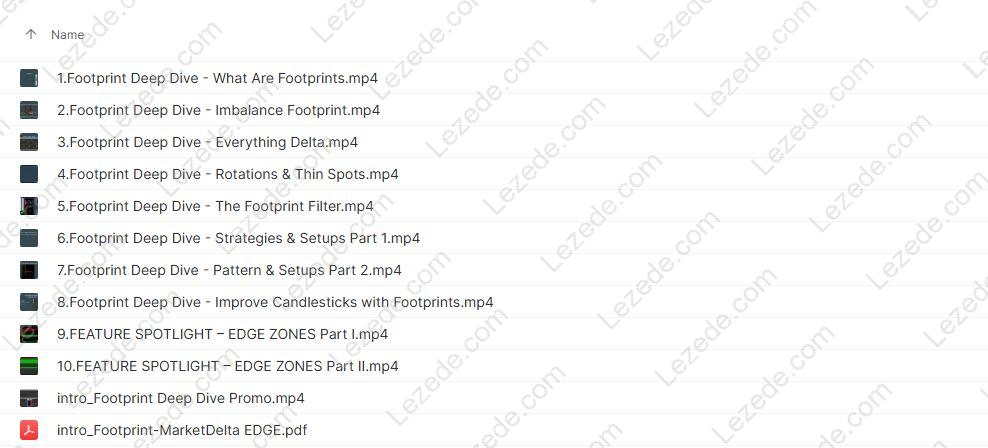

Check content proof, now:

Footprint Deep Dive by MarketDelta: Unlocking the Potential of Footprint Charts

In the fast-changing landscape of trading, having a deep grasp of market activity is a decisive advantage. MarketDelta’s Footprint Deep Dive is a specialized training program created to help traders master the use of footprint charts—dynamic tools that deliver a detailed view of order flow and price action. Designed for beginners through to advanced professionals, the course blends core principles with sophisticated trading techniques to significantly sharpen market analysis skills. This breakdown explores the course’s structure, its benefits, and how it translates theory into actionable strategies.

Course Overview

The Footprint Deep Dive program provides a rich mix of training videos and materials that methodically explain how footprint charts work. These visual tools go beyond basic candlestick or bar charts by showing a deeper layer of market data—revealing buying vs. selling pressure, volume distribution, and order flow in real time.

Participants will learn not just the theory behind footprint charts, but also how to apply them in everyday trading decisions. Whether the goal is to build a strong foundational understanding or to gain advanced analytical techniques, the course is structured to meet the needs of a wide range of traders.

Key Learning Points

Building a Solid Foundation

The first stage of the course focuses on understanding what footprint charts are and why they matter. Traders will see how these charts differ from standard price charts and why their granular view of market activity can reveal important dynamics that might otherwise be missed.

Creating and Customizing Footprint Charts

Once the basics are clear, the course moves into chart construction and interpretation. Students learn how to create charts from scratch, adapt settings for different strategies, and incorporate tools like volume profiles and order flow analytics to match their personal trading approach.

Order Flow Mastery

Order flow is a core element of this program. By learning to read buying and selling imbalances as they occur, traders gain the ability to respond to shifting market sentiment more effectively. Real examples and live market scenarios show how to interpret these signals and integrate them into trade execution.

Recognizing Trends and Rotations

The course also teaches traders to spot market rotations and identify “thin spots” or low-liquidity zones. This insight helps in adjusting strategies to current market conditions, improving timing for entries and exits.

Real-time Support and Resistance

Participants will also master identifying support and resistance levels as they form, a skill critical for anticipating price movements. Using footprint chart data, traders can pinpoint these zones with greater precision than with traditional charting tools.

Course Structure

The self-paced curriculum spans roughly 9 hours of in-depth content, organized into modules that build on each other for a smooth learning progression:

-

Introduction to Footprint Charts

-

Creating and Reading Footprint Charts

-

Strategic Applications in Trading

-

Detailed Order Flow Techniques

-

Market Rotation & Support/Resistance Analysis

-

Real-World Trading Scenarios with Expert Insights

This modular approach allows traders to absorb complex topics gradually while reinforcing concepts with hands-on examples.

Target Audience

The course is designed to benefit:

-

New Traders seeking strong fundamentals in market analysis.

-

Experienced Traders looking to enhance strategy with advanced footprint techniques.

-

Analytical Thinkers who enjoy using data to make precise, informed market decisions.

Regardless of prior experience, each module delivers value, making the program accessible and rewarding for all participants.

Conclusion

MarketDelta’s Footprint Deep Dive stands out as a comprehensive, practical guide for mastering footprint charts. It bridges the gap between understanding market theory and applying that knowledge in real trades. By combining expert instruction, real-market examples, and flexible learning, it equips traders with the tools to interpret market activity at a deeper level and make more confident, data-driven decisions.

For traders committed to refining their edge, this course is more than just technical training—it’s a gateway to trading with clarity, precision, and confidence.