A Plan to make 10% monthly in Feb. & Mar. 2024 by Dan Sheridan Free Download – Includes Verified Content:

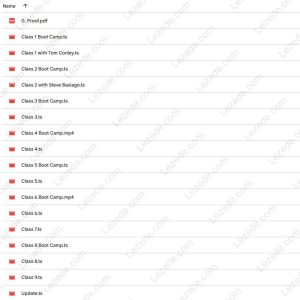

A Plan to make 10% monthly in Feb. & Mar. 2024 by Dan Sheridan Free Download, Watch content proof here:

A Plan to make 10% monthly in Feb. & Mar. 2024 by Dan Sheridan – Free Download Video Sample:

Comprehensive Review: Dan Sheridan’s 10% Monthly Return Plan (Feb–Mar 2024)

In today’s fast-moving financial markets, the pursuit of consistent, repeatable profits is a central goal for many traders. Dan Sheridan’s “Plan to Make 10% Monthly”—unveiled for February and March 2024—offers a disciplined, education-driven roadmap designed to help options traders work toward this ambitious benchmark. Combining robust strategy instruction, real-time mentoring, performance tracking, and community support, this plan stands out as both a training program and a practical trading framework.

Below, we break down the core elements of this plan and assess its structure, accessibility, and potential effectiveness for traders at any level.

🎓 Educational Courses: Building a Strategic Foundation

A defining strength of Sheridan’s program is its deep emphasis on education. The course material is structured to serve both novice and intermediate options traders, offering video-based tutorials that demystify complex topics and teach traders how to apply proven strategies like calendars, butterflies, and iron condors in real market conditions.

Why It Works:

-

Accessible learning: Self-paced videos allow flexibility for busy traders.

-

Focused instruction: Lessons are centered on strategies designed to meet the monthly return target.

-

Reinforcement through repetition: Course members are encouraged to revisit materials to strengthen comprehension.

This strong educational base not only helps traders execute more confidently, but it encourages long-term growth and market adaptability—critical for sustainable trading success.

🎯 Clear Monthly Targets and Performance Tracking

Sheridan’s program emphasizes goal-setting and performance accountability. Traders are encouraged to define monthly targets—like the 10% return goal—and monitor their progress with deliberate discipline.

Core components include:

-

Realistic goal setting: Anchors traders with attainable expectations based on strategy and account size.

-

Ongoing trade tracking: Encourages daily and weekly analysis of open positions and adjustments.

-

Market-responsive revisions: Traders learn how to adapt their tactics when volatility or conditions change.

By promoting this results-focused mindset, the plan instills a sense of ownership and responsibility, pushing traders to follow through with risk-managed decisions.

🔍 Live Trade Reviews and Tactical Adjustments

One of the most valuable elements of Sheridan’s methodology is live trade review sessions, where he breaks down recent trades, both successful and unsuccessful. These walkthroughs offer participants rare insight into a professional trader’s real-time thought process.

What Traders Gain:

-

A step-by-step look at why trades were opened, how they were managed, and when adjustments were made.

-

Exposure to common mistakes and how to avoid them.

-

Interactive opportunities to ask questions and discuss trade logic in a group setting.

These reviews transform theory into actionable wisdom, allowing traders to internalize lessons that go far beyond textbook scenarios.

🤝 Community and Real-Time Support

Unlike many self-guided programs, Sheridan’s plan incorporates a vibrant trading community, providing a shared learning experience via platforms like Discord. Here, participants can:

-

Exchange trade ideas.

-

Receive feedback on strategy adjustments.

-

Collaborate during live market hours with Dan and fellow traders.

Why this matters:

-

Peer accountability strengthens consistency.

-

Exposure to different perspectives broadens strategic thinking.

-

Emotional support helps mitigate trading stress.

For newer traders, the sense of belonging can reduce hesitation and improve confidence. For experienced traders, it offers a space to refine and optimize techniques collaboratively.

🔄 Strategic Flexibility: Adapting to Market Conditions

Sheridan’s approach isn’t rigid. Instead, the plan emphasizes the importance of being strategically adaptive by rotating between various options strategies depending on the market environment.

Key strategies include:

-

Calendar spreads: Ideal for low-volatility, range-bound markets.

-

Butterfly spreads: Effective when expecting little directional movement.

-

Credit spreads and iron condors: Useful in neutral or sideways markets.

Each strategy is taught not just for mechanics, but for contextual deployment, empowering traders to pick the right tool for each market condition. This strategic agility is essential for aiming at consistent returns regardless of macro trends.

📚 Continuous Learning Through Archived Content

In addition to live content, traders receive access to a rich archive of previously recorded classes—an invaluable asset for reinforcing key concepts or reviewing missed sessions.

Benefits of this ongoing education model:

-

24/7 access to Sheridan’s full strategy library.

-

Ability to revisit strategies that may become relevant under new conditions.

-

Support for a growth mindset, where trading is approached as a craft that improves over time.

This blend of live interaction and evergreen material keeps traders sharp and responsive, even after the official program ends.

⚠️ Risk Management and Trading Discipline

No plan to achieve consistent returns is complete without a thorough risk management framework, and Sheridan’s plan addresses this directly.

Traders are taught how to:

-

Size positions based on account risk tolerances.

-

Set intelligent stop-loss and adjustment thresholds.

-

Use hedging techniques where appropriate.

Coupled with lessons in trading psychology, the program equips participants to manage emotion-driven errors, stay objective, and remain focused on long-term success.

🧩 Who Should Take This Course?

| Trader Profile | Benefit from This Plan |

|---|---|

| Beginner | Learn foundational options strategies in a guided, risk-conscious way. |

| Intermediate | Enhance trade execution and refine adjustment techniques. |

| Advanced | Gain an edge through structured accountability, reviews, and community collaboration. |

✅ Conclusion: A Practical, Structured Path to Consistent Returns

Dan Sheridan’s “Plan to Make 10% Monthly” offers far more than a bold performance target—it delivers a comprehensive trading system grounded in education, disciplined execution, and community-driven growth. While no program can guarantee a fixed monthly return, this course provides the tools, mindset, and mentorship necessary to help serious traders pursue those returns with focus and integrity.

Whether you’re looking to build a solid options foundation, scale up your monthly profits, or join a results-oriented trading community, this program is a strong step forward in that journey.