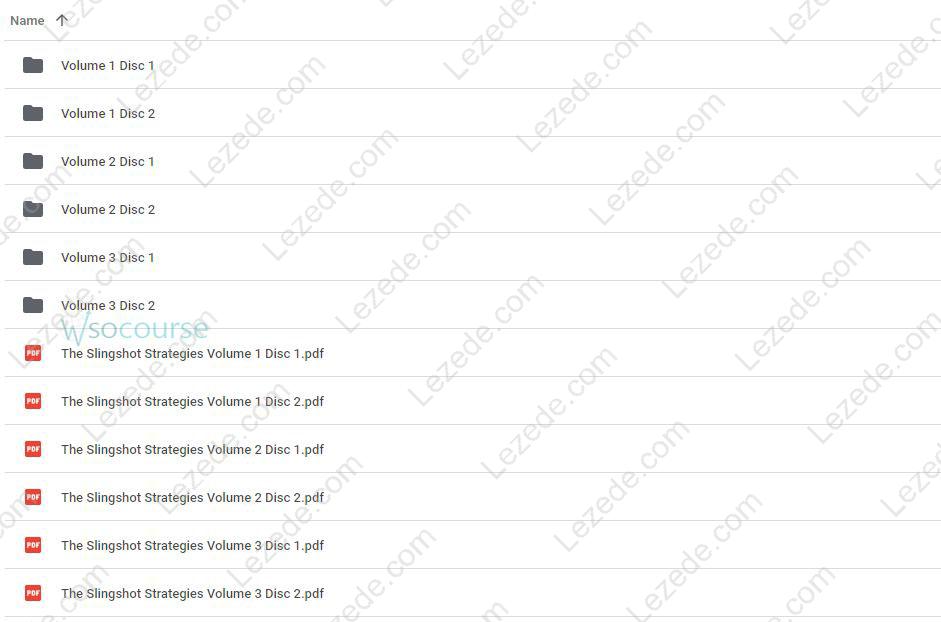

Planting Landmines for Explosive Profits by Dave Slingshot Free Download – Includes Verified Content:

Review of Planting Landmines for Explosive Profits by Dave Slingshot

Within the world of financial literature, Dave Slingshot’s Planting Landmines for Explosive Profits emerges as a striking examination of bold, high-reward trading approaches. This review explores the main ideas within the book, connecting battlefield strategies to market tactics, and highlighting the indispensable role of knowledge and disciplined risk management in generating substantial returns.

Decoding the Metaphor: Landmines in the Financial Arena

The title Planting Landmines for Explosive Profits uses a powerful military analogy to represent the strategic positioning necessary in high-stakes investments. Just as landmines can offer a decisive advantage yet carry inherent danger, Slingshot’s techniques involve setting up targeted market positions that can deliver major profits—if conditions align.

Here, “planting landmines” refers to deliberately establishing trades or positions primed to respond when specific market triggers occur. Much like a battlefield mine detonates under certain circumstances, these positions are placed to deliver optimal gains when the market moves favorably.

Explosive Profits: Harnessing High Risk for Big Rewards

At the heart of Slingshot’s philosophy is the pursuit of “explosive profits,” describing the potential for rapid, sizable gains in volatile environments. His strategies—often applicable to fast-moving markets like forex—seek to exploit these sharp movements with precisely timed entries and exits.

Forex trading, with its constant price swings, offers opportunities for large profits in short time frames, but equally large potential losses. Slingshot’s methods appear to blend aggressive positioning with strict leverage control, aiming to maximize gains while avoiding catastrophic drawdowns.

The Power of Knowledge and Market Insight

A key theme in Slingshot’s approach is that success hinges on deep market understanding. This involves studying economic indicators, price action, and trend behavior to inform decisions. His focus on knowledge acquisition signals that his trading is grounded in research and analysis—not guesswork.

Slingshot encourages traders to pair education with real or simulated practice, refining strategies and building confidence before risking significant capital. This blend of study and experience promotes discipline, which is critical in fast-moving markets.

Managing Risk in Aggressive Trading

While chasing explosive profits is appealing, Slingshot’s framework acknowledges that unmanaged risk can quickly erase gains. His techniques likely integrate several core risk management tools:

-

Diversification – Allocating across assets or strategies to minimize concentrated risk.

-

Position Sizing – Adjusting trade size to fit both the market’s volatility and the trader’s tolerance.

-

Stop-Loss Orders – Predetermining exit points to prevent excessive losses.

-

Ongoing Monitoring – Continually assessing and adjusting trades as market conditions change.

This balanced approach ensures traders can remain aggressive without jeopardizing capital stability.

Slingshot’s Tactical Trading Framework

Slingshot’s comparisons between military tactics and market operations reinforce the importance of planning, precision, and adaptability.

-

Strategic Positioning – Choosing market entry and exit points based on analysis to maximize profit potential.

-

Tactical Execution – Acting with precision and timing to exploit favorable setups.

-

Adaptive Strategies – Modifying positions as market dynamics shift.

-

Volatility Advantage – Turning rapid price movement into profit potential with advanced techniques.

Final Thoughts

Planting Landmines for Explosive Profits presents a unique fusion of military-inspired strategy and high-intensity trading methodology, especially relevant to forex and other volatile markets. Slingshot underscores that success requires more than ambition—it demands deep knowledge, strategic foresight, and rigorous risk control.

For traders willing to navigate high-risk environments, this book provides a clear roadmap for leveraging volatility while protecting capital. By combining strategic insight, technical skill, and disciplined execution, Slingshot offers readers a structured path to potentially explosive market gains.