CM APR (A Pivot Reverse) Trade Method by Austin Passamonte Free Download – Includes Verified Content:

A Comprehensive Review of the CM APR (A Pivot Reverse) Trade Method by Austin Passamonte

In the fast-paced world of trading, the strategies you use can often be the deciding factor between success and failure. One such method, the CM APR (A Pivot Reverse), developed by Austin Passamonte, offers a well-structured framework for traders seeking to navigate the complexities of the market. By relying on dynamic pivot points, the CM APR method aids traders in managing their trades more effectively and identifying optimal entry points. This adaptability allows traders to stay ahead of market shifts and make informed decisions.

Understanding the CM APR (A Pivot Reverse) Trade Method

The CM APR method is built on dynamic pivot points, which are crucial indicators that continuously adjust according to real-time market data. Unlike static pivots, which remain fixed, dynamic pivots change in response to ongoing market conditions. This real-time adaptability helps traders spot potential reversal points—key moments where the market’s price direction may change.

In essence, the CM APR method serves as a compass, guiding traders through market uncertainties. These pivot points are instrumental in identifying both entry and exit points, offering traders a more responsive approach to market movements.

Key Features of the CM APR Method

| Feature | Description |

|---|---|

| Dynamic Pivot Points | Real-time updates based on live market data |

| Reversal Point Indicators | Helps identify potential price trend reversals |

| Trade Optimization | Improves strategies for entering and exiting trades effectively |

Dynamic Pivot Points: The Core of the CM APR

Dynamic pivots are central to the CM APR method, continuously adjusting as market conditions evolve. These pivots provide traders with the ability to evaluate market sentiment and predict potential changes in price direction. By analyzing pivot points, traders gain foresight into market trends—helping them adjust their strategies to avoid unexpected market volatility.

These pivots are calculated using data from price levels such as high, low, and close from previous trading sessions. This method allows the CM APR to be versatile in both bullish and bearish markets, providing traders with actionable insights for making timely decisions.

Benefits of Dynamic Pivot Points

-

Real-Time Adaptability: Reflects current market conditions for accurate decision-making.

-

Enhanced Precision: Provides more accurate signals for potential trade opportunities.

-

Versatility: Effective across different market environments, from high volatility to stability.

Mastering Trade Management Techniques

Trade management is a key aspect of the CM APR method. The strategy incorporates trailing stops, which are orders that automatically adjust to lock in profits as the price moves in the desired direction. This technique allows traders to protect their profits while giving their trades the space to grow further.

By employing trailing stops and other trade management techniques, traders can minimize emotional influences and maintain consistency in their trading approach. The method promotes a disciplined, proactive strategy aimed at maximizing profits while managing risks effectively.

Trade Management Strategies in CM APR

| Trade Management Technique | Description |

|---|---|

| Trailing Stops | Dynamic orders that adjust to lock in profits as prices move favorably |

| Risk Minimization | Strategies to limit potential losses |

| Consistent Execution | Following a predefined trading plan with discipline |

The Impact of Effective Trade Management

Effective trade management shifts trading from a reactive to a proactive strategy. By locking in profits and controlling risks, traders can focus on executing their strategies without constant concern for individual trades. This approach not only enhances performance but also cultivates a more balanced and resilient trading portfolio.

Austin Passamonte: A Legacy of Trading Excellence

With over three decades of experience, Austin Passamonte has become a respected figure in the trading community. His extensive background, combined with his practical insights, is reflected in the CM APR method, providing traders with both technical knowledge and psychological strategies for success. Passamonte’s focus on consistency and discipline is woven throughout the course materials, helping traders adopt a methodical approach to long-term profitability.

Contributions to Trading Education

-

Experience-Based Insights: Draws on decades of practical trading experience.

-

Psychological Aspects: Emphasizes mental resilience in the trading process.

-

Adaptive Strategies: Focuses on adjusting methods based on market changes.

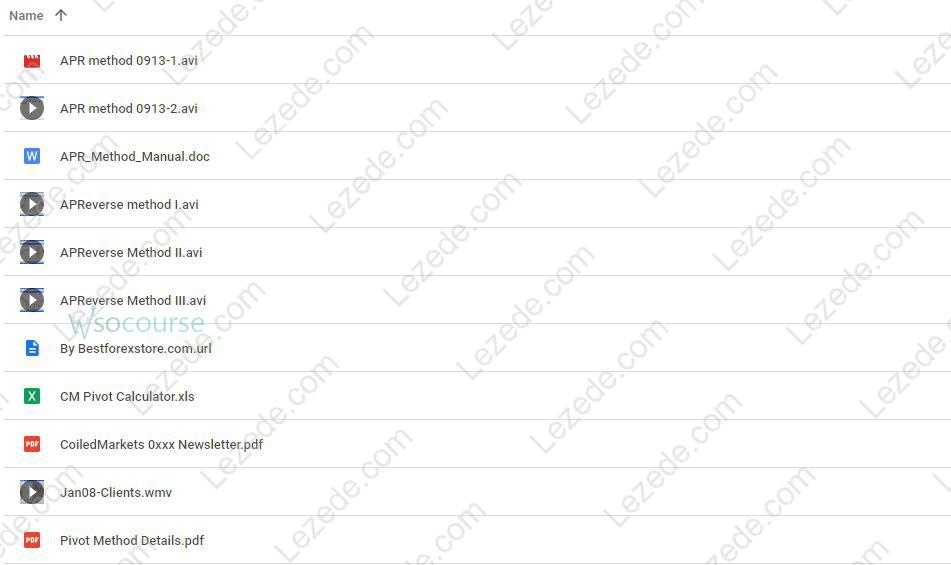

Comprehensive Educational Materials: Learning the CM APR Method

The CM APR method is delivered digitally, with a combination of video tutorials, manuals, and trade strategy codes. These materials are designed to cater to traders of all levels, from beginners to experienced professionals. This diverse educational approach ensures traders have access to a comprehensive learning experience.

| Educational Tool | Purpose |

|---|---|

| Video Tutorials | Step-by-step guides demonstrating the application of the CM APR method |

| Manuals | In-depth written content covering theory and practical implementation |

| Trade Strategy Codes | Ready-to-use codes for automating CM APR strategies on trading platforms |

Advantages of the Digital Format

-

Accessibility: Learn at your own pace with online materials.

-

Comprehensive Coverage: All aspects of the CM APR method are covered in detail.

-

Interactive Learning: Engages users with various learning mediums for better retention.

Enhancing Trading Proficiency

By combining practical examples with interactive learning, the CM APR method ensures that traders, regardless of their experience level, can apply the strategies with ease. This approach fosters proficiency and prepares traders to handle real-world market conditions effectively.

Pricing and Availability: Accessibility and Value

The CM APR materials are available in a digital format, making them easy to integrate into daily trading routines. Passamonte’s affordable pricing structure ensures that traders of all levels can access this valuable resource without breaking the bank.

Tailored for All Skill Levels

| Trader Type | Recommended Starting Method |

|---|---|

| Novice Traders | Introductory modules covering basic concepts and strategies |

| Intermediate Traders | Advanced tutorials focusing on strategy optimization and fine-tuning |

| Experienced Traders | Comprehensive strategies for diversifying and enhancing existing trades |

Why Choose the CM APR Method

The CM APR method offers traders a structured, adaptive approach to trading, grounded in dynamic pivot points and effective trade management techniques. Whether you’re a novice or an experienced trader, the CM APR method equips you with the tools necessary to thrive in various market conditions. Its combination of flexibility, affordability, and comprehensive education makes it an excellent choice for those looking to succeed in the financial markets.

Conclusion

The CM APR trade method by Austin Passamonte offers a comprehensive, systematic approach to trading. With a focus on dynamic pivot points, trade management, and educational resources, the method equips traders with the tools needed to navigate market fluctuations successfully. Whether you’re just starting out or looking to refine your trading strategies, the CM APR method is a reliable resource designed to enhance trading performance across different market conditions.