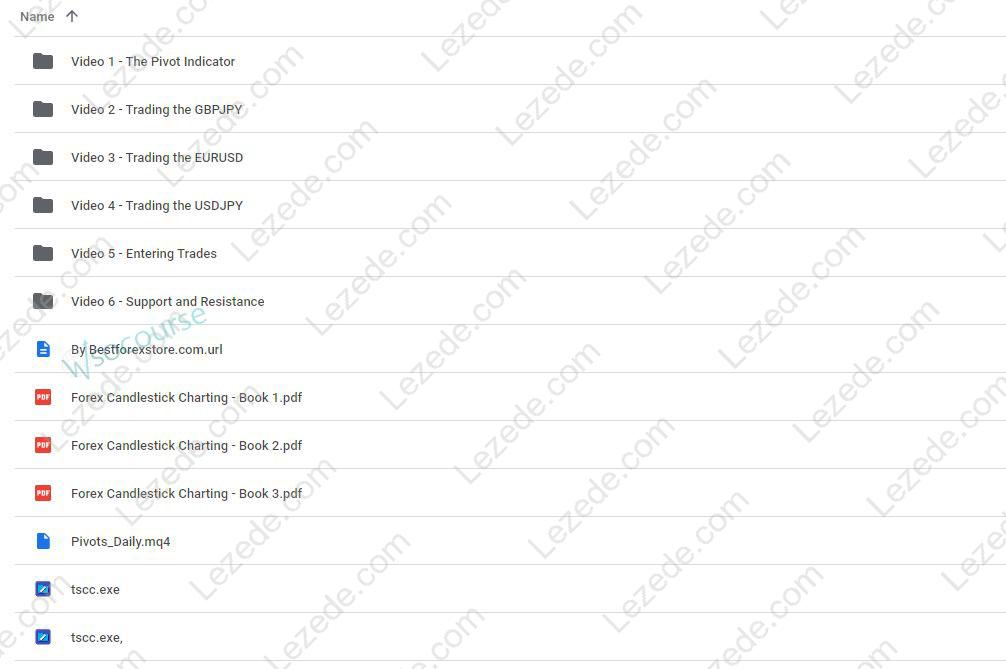

Forex Candlestick System. High Profit Forex Trading by B.M.Davis Free Download – Includes Verified Content:

High Profit Forex Trading by B.M. Davis: A Comprehensive Analysis

Navigating the complexities of forex trading requires a combination of knowledge, strategy, and tools to minimize risk while maximizing profit. B.M. Davis’s book, High Profit Forex Trading, offers an in-depth exploration of the forex market with a primary focus on candlestick pattern analysis. This review will examine the key aspects of Davis’s approach, detailing how his system provides traders with the necessary tools to interpret market movements, manage risks, and execute profitable trades consistently.

The Power of Candlestick Patterns in Forex Trading

At the core of Davis’s trading approach is his focus on candlestick patterns. These patterns provide a visual representation of market sentiment and potential price movements. Candlestick charts are revered for their ability to distill complex market information into a straightforward format, which makes them essential for traders seeking to make quick, informed decisions.

Davis categorizes candlestick formations into three main types: bullish, bearish, and continuation patterns. For instance, the bullish engulfing pattern signals a reversal from a downtrend, while the bearish harami may indicate the opposite. By mastering these patterns, traders can better anticipate market trends and make smarter decisions.

Additionally, Davis emphasizes that candlestick patterns should not be analyzed in isolation. They should always be validated by other technical indicators and broader market conditions. This holistic approach ensures that traders avoid making decisions based solely on patterns and instead take into account the entire market context, thus improving the accuracy of their predictions.

The Role of Market Psychology

A significant portion of Davis’s book is dedicated to understanding market psychology—the emotional and behavioral factors that drive market fluctuations. Traders who can decode the psychological state of the market gain an edge by understanding the motivations behind price movements.

Davis explains how candlestick patterns can reflect the ongoing battle between buyers and sellers, capturing emotions like fear, greed, and optimism. For example, a doji candlestick, which signals indecision, may indicate that a major price movement is on the horizon once the prevailing sentiment takes hold again.

Through real-world examples, Davis demonstrates how market psychology can influence trading decisions, and he offers strategies to mitigate common pitfalls like confirmation bias and overtrading. Understanding these psychological influences helps traders stay disciplined and make more rational, informed decisions.

Effective Risk Management Techniques

Risk management is a central theme in Davis’s trading methodology. He stresses that without effective risk management, even the best trading strategies can result in significant losses. One of the key techniques he introduces is the use of stop-loss orders, which automatically close a trade at a preset price level to limit potential losses.

Additionally, Davis recommends calculating risk-reward ratios to evaluate the profitability of trades. A ratio of 1:3, for example, indicates that for every unit of risk, there is a potential reward of three units. This approach helps traders prioritize high-potential trades while minimizing risk exposure.

Davis also suggests diversifying trading strategies and spreading capital across different currency pairs. By reducing exposure to any single position, traders can better manage their risk and protect their capital in fluctuating market conditions.

Practical Strategies for Forex Trading

The book provides a wealth of practical trading strategies designed to take advantage of candlestick patterns. These strategies cater to different trading styles, including day trading, swing trading, and scalping, allowing traders to choose the best approach based on their personal preferences and time availability.

For instance, Davis recommends identifying breakout opportunities when a bullish candlestick pattern forms near a strong support level, signaling the potential for a price surge. Conversely, bearish patterns near resistance levels may signal a short-selling opportunity.

In addition to these strategies, Davis explores trend-following techniques, which involve trading in the direction of an existing trend. By aligning trades with prevailing market trends, traders increase their chances of success. He also touches on counter-trend strategies, which involve trading against the prevailing trend when certain candlestick patterns signal a reversal.

Integrating Technical Indicators for Enhanced Accuracy

While candlestick patterns are powerful on their own, Davis emphasizes the value of incorporating other technical indicators to strengthen trading decisions. Indicators like Moving Averages (MA), Bollinger Bands, and the Relative Strength Index (RSI) provide crucial quantitative data that can confirm or challenge candlestick signals.

For example, when a bullish candlestick pattern aligns with an RSI reading below 30, it signals oversold conditions, increasing the likelihood of a successful long trade. Similarly, a bearish pattern combined with an RSI above 70 can confirm the signal to sell.

Davis explains how to use these indicators in conjunction with candlestick patterns to refine trade setups and enhance the reliability of market predictions. By integrating multiple technical tools, traders can increase the accuracy of their trading strategies.

The Importance of Backtesting and Continuous Evaluation

Backtesting is another key aspect of Davis’s system. By testing strategies on historical data, traders can assess their effectiveness in various market conditions. This process helps identify the strengths and weaknesses of a strategy, allowing traders to make improvements before applying it in live markets.

Davis advocates for a disciplined approach to backtesting, emphasizing the need to evaluate strategies over multiple market cycles. He also recommends using software tools to automate the process, which helps streamline analysis and increase accuracy.

In addition to backtesting, Davis encourages continuous learning. As market conditions evolve, traders should re-test and adjust their strategies to ensure they remain relevant and effective.

Real-World Examples to Reinforce Strategy

To make his concepts more relatable, Davis includes numerous real-world examples of how his strategies and candlestick patterns are applied in actual trading scenarios. For example, one case study involves a trader identifying a hammer candlestick at the bottom of a downtrend, signaling a potential reversal. By confirming this signal with other indicators, the trader enters a long position and profits as the market moves upwards.

These practical examples help illustrate the effectiveness of Davis’s system in real market conditions, providing readers with concrete insights they can apply to their own trading.

Conclusion

B.M. Davis’s High Profit Forex Trading offers a comprehensive and methodical approach to forex trading, emphasizing the importance of candlestick patterns, technical indicators, market psychology, and sound risk management. Through practical strategies and real-world examples, Davis provides traders with a solid framework for achieving consistent, profitable trades. The book is ideal for traders of all levels, offering both theoretical insights and actionable strategies that can be immediately applied to the market.

By integrating Davis’s teachings, traders can refine their skills, reduce emotional biases, and enhance their decision-making, ultimately leading to more profitable trading outcomes.