Free Download Live April-June 2024: Short Term Iron Condors by Dan Sheridan – Includes Verified Content:

Live April-June 2024: Short Term Iron Condors by Dan Sheridan – You can Freely watch the Content Proof below:

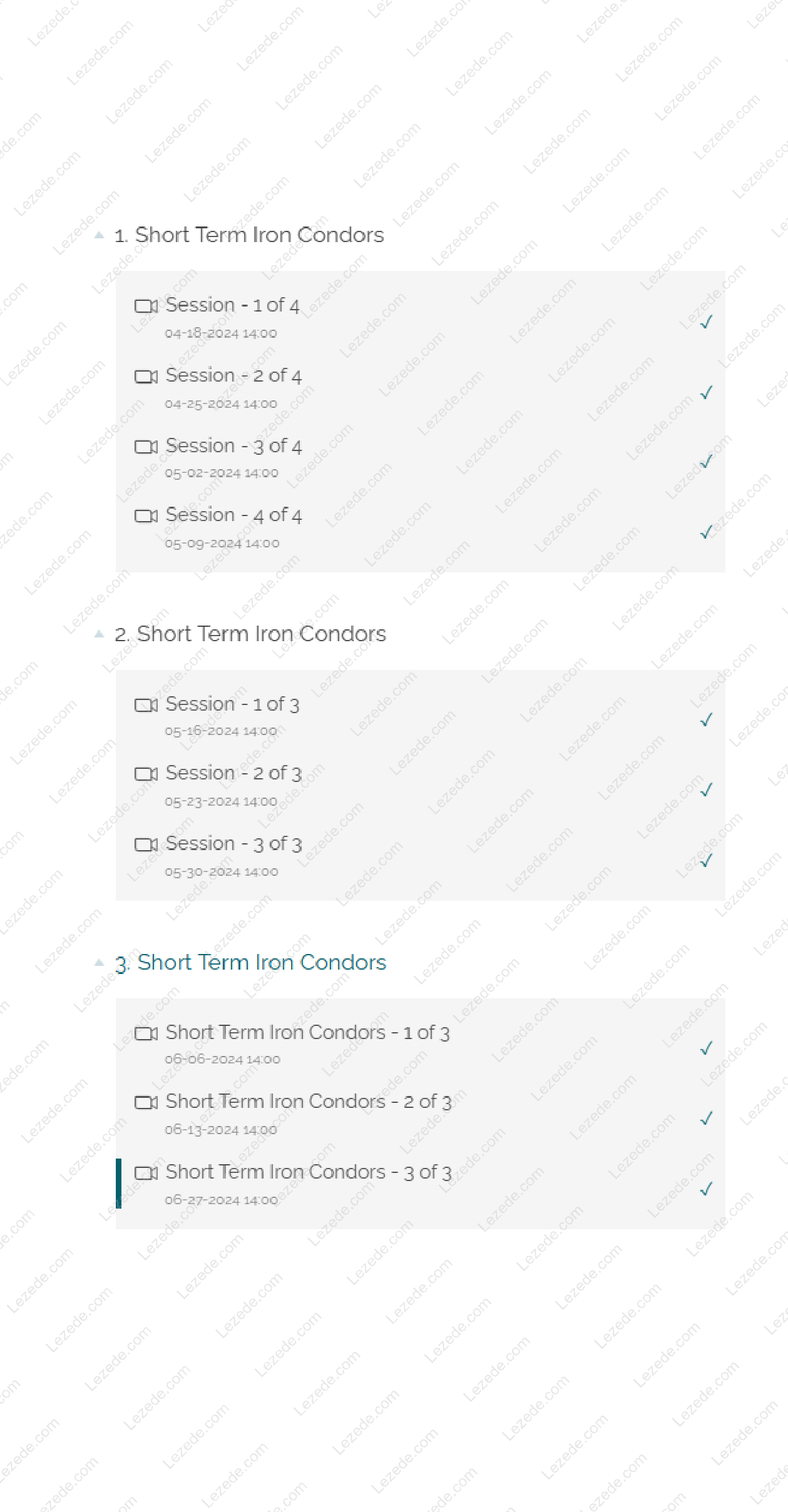

Live April–June 2024: Short Term Iron Condors by Dan Sheridan

Trading options is an ever-evolving journey, and one of the most challenging yet rewarding strategies for traders is the short-term Iron Condor. In the course “Live April–June 2024: Short Term Iron Condors”, Dan Sheridan, a veteran in the options trading world, provides a deep dive into Zero Day to 4-Day Iron Condors. These trades demand precision, timing, and above all, rigorous risk management. If you’ve been seeking an opportunity to refine your short-term trading skills and learn from one of the best, this course offers the clarity and hands-on practice you need.

What Are Short Term Iron Condors?

An Iron Condor is an options strategy designed to profit from a market that trades within a specific range. By selling both a call spread and a put spread, traders collect premium and benefit if the underlying asset stays within the chosen strike prices.

When it comes to short-term Iron Condors—specifically those with expiration windows from same-day (Zero DTE) to four days—the risks and rewards are heightened. These positions can generate profits quickly, but they also leave little room for error. As Dan Sheridan emphasizes, these trades demand precise entry points, disciplined exits, and well-defined adjustments.

Key Lessons in This Course

This course doesn’t just outline the mechanics of Iron Condors; it delivers a practical blueprint that you can apply immediately in real market conditions. Here’s what you’ll learn:

-

What strikes to sell and buy: Dan shares his proven method for selecting the optimal strike prices to balance risk and reward.

-

When to enter and exit trades: Timing is critical in short-term setups. You’ll gain insight into when to open the position, when to take profits, and when to exit before losses compound.

-

Risk management strategies: Because these trades can move quickly against you, Dan provides rules for managing losses and preventing account blowups.

-

Profit-taking techniques: Discover when to close your position for maximum efficiency, rather than holding too long and exposing yourself to unnecessary risk.

By the end of this course, you will not only understand how short-term Iron Condors work but also have a structured plan for execution, management, and consistent profitability.

Special Collaboration with Options Omega

A standout feature of this program is the collaboration with Options Omega, represented by Troy McNeil. Options Omega is widely respected for its powerful backtesting tools, which help traders evaluate strategies under various market conditions. By incorporating their insights, this course provides you with an even stronger foundation to approach Zero Day and very short-term trades confidently.

With access to backtesting data and real-world applications, you’ll gain the ability to see not just theory, but how these strategies perform historically and practically.

Why Short-Term Iron Condors Matter

The financial markets, particularly indexes like SPX, have become increasingly volatile in the short term. Daily market swings create opportunities for traders who can adapt quickly and control their risks. Short-term Iron Condors allow you to capitalize on this volatility while maintaining clear boundaries for profit and loss.

Dan Sheridan stresses that these strategies aren’t just about chasing quick profits—they’re about developing discipline. Each trade is a test of your ability to follow rules, stick to your plan, and avoid emotional decision-making. For traders ready to elevate their discipline, this course serves as both a challenge and a guide.

Learn from Dan Sheridan

With over 30 years of experience in the options market, Dan Sheridan brings unmatched expertise to his students. His career began as a market maker at the CBOE with the renowned firm Mercury Trading, where he worked alongside Jon and Pete Najarian. During that time, Dan trained many successful traders, including Pete Najarian, who later became a host on CNBC’s Fast Money.

In 2004, Dan transitioned from the trading pits to education, founding Sheridan Risk Management. Since then, he has dedicated his career to teaching individual traders how to succeed with the same strategies he used professionally. Dan frequently appears on the TDAmeritrade Network, has been featured at CBOE.com, and collaborates with major brokers like Interactive Brokers through educational webinars.

Who Is This Course For?

This course is designed for:

-

Intermediate to advanced traders who want to specialize in short-term options strategies.

-

Day traders seeking to diversify their playbook with structured trades that can work within 0–4 days.

-

Risk-conscious investors who understand the importance of managing downside while capturing premium income.

-

Options enthusiasts ready to learn from one of the most respected educators in the industry.

Whether you’re new to Iron Condors or looking to master the short-term versions, this course provides everything you need to trade with confidence.

What You’ll Gain

By the end of “Live April–June 2024: Short Term Iron Condors”, you will:

-

Understand how to construct Zero Day to 4-Day Iron Condors.

-

Have a step-by-step trading plan for entries, exits, profits, and losses.

-

Gain hands-on exposure through live trades executed by Dan.

-

Learn how to apply backtesting data to refine your strategies.

-

Build confidence in managing short-term volatility without panic.

This course is more than just theory—it’s live, practical, and guided by a mentor who has trained thousands of successful traders.

Final Thoughts

Short-term Iron Condors can be intimidating, but with the right training, they become a powerful addition to your trading arsenal. Dan Sheridan’s methodical approach, combined with Options Omega’s data-driven insights, ensures that you aren’t just gambling—you’re trading with structure, discipline, and confidence.

If you’re ready to face the challenges of fast-moving markets and come out ahead, this course will prepare you to succeed.