Candlestick Charting Explained By Greg Morris – Download Proof of Content for Free here:

Candlestick Charting Explained By Greg Morris – Watch Content Proof here:

Candlestick Charting Explained by Greg Morris: Master 89 Powerful Patterns for Technical Trading

Candlestick Charting Explained by Greg Morris is the go-to resource for traders seeking a practical and professional understanding of candlestick charting. Now in its expanded third edition, this comprehensive guide goes far beyond basic pattern recognition—teaching traders how to integrate candlestick patterns with Western charting techniques for enhanced signal accuracy.

Whether you’re new to technical analysis or want to sharpen your precision in identifying market sentiment, this book is a must-have addition to your trading toolkit.

A Timeless Japanese Charting Method, Modernized

Candlestick charting originated with Japanese rice traders centuries ago, but Greg Morris brings it fully into the modern trading landscape. In this book, you’ll find:

-

Up-to-date analysis and revised charts

-

New material on integrating Japanese and Western analysis

-

A systematic, rules-based approach to pattern recognition

Morris transforms candlestick interpretation from subjective guesswork into a logical, structured discipline.

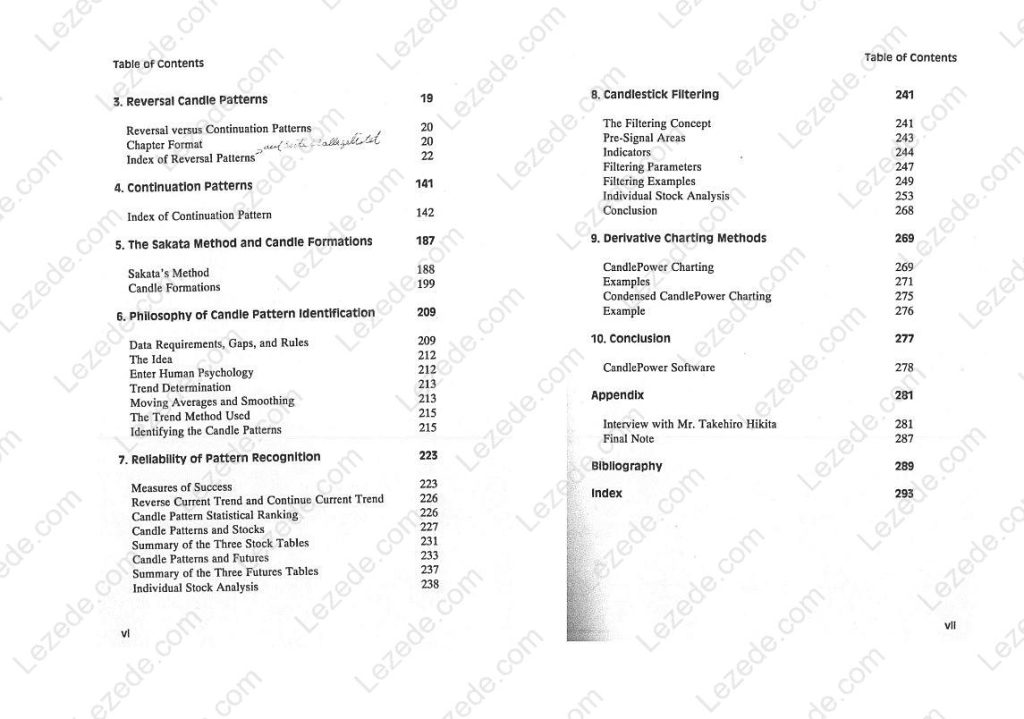

Standardized Coverage of 89 Candle Patterns

The core of the book is its standardized breakdown of 89 distinct candlestick patterns. Each pattern comes with:

-

Clear description and historical context

-

Rules of recognition for accurate identification

-

Psychological insights into trader behavior

-

Pattern flexibility and real-world variations

-

Related patterns and potential confusions

-

Visual examples to eliminate costly mistakes

This makes the book a practical reference traders can turn to in live-market conditions.

Psychology Behind the Candles

Greg Morris dives into the emotional narrative behind each candlestick, revealing:

-

What buyers and sellers are likely thinking

-

How fear, greed, and indecision are expressed in candles

-

How to interpret subtle shifts in market sentiment

This psychological depth sets this book apart from surface-level pattern guides.

Integrating Candlesticks with Western Technical Tools

Rather than isolate candlestick charting, Morris shows how to combine it with:

-

Moving averages and trend lines

-

Support/resistance levels

-

Volume and momentum indicators

This integrated approach provides stronger, more reliable trading signals.

Avoiding False Signals and Pattern Filtering

One of the most valuable additions in this edition is a chapter on pattern filtering—a method to improve signal accuracy by removing noise from volatile markets. You’ll also learn:

-

How to validate signals with intraday data

-

When confirmation is necessary—and when it isn’t

-

The importance of trend context in pattern interpretation

This approach empowers traders to make better decisions and avoid common traps.

Practical Application for Today’s Markets

In a new section by Ryan Litchfield, traders are given real-world guidance on:

-

Trading with candlesticks in today’s algorithmic market

-

Interpreting intraday candle patterns

-

Using candles across different timeframes (daily, weekly, intraday)

This ensures readers can apply lessons directly to modern trading platforms and strategies.

About the Author: Greg Morris

Gregory L. Morris is a globally recognized authority on candlestick charting. A portfolio manager and seasoned educator, he brings decades of experience in market breadth analysis and technical trading. He has presented to thousands of traders worldwide and played a pivotal role in popularizing candlestick charting in the West.

Final Thoughts on Candlestick Charting Explained

Candlestick Charting Explained by Greg Morris is more than a technical analysis manual—it’s a complete trading reference. With its blend of historical insight, practical tools, and modern relevance, this guide helps traders decode market behavior and sharpen their entries and exits with confidence.

If you want to stop reacting blindly to the market and start trading with clarity, this book is the edge you need.