Free Download Ez-Forex Trading System 4.2 by Beau Diamond

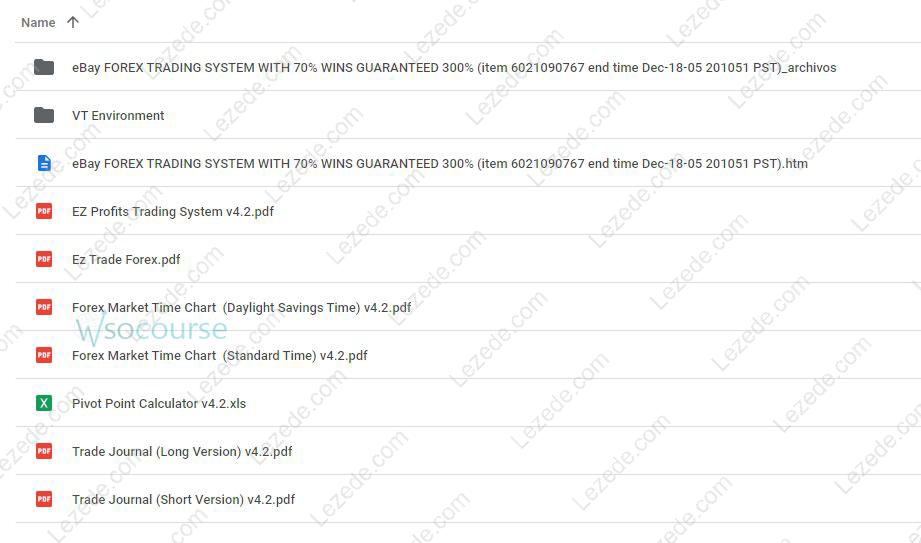

Check content proof, now:

Ez-Forex Trading System 4.2 by Beau Diamond: A Comprehensive Review

The Ez-Forex Trading System 4.2, developed by Beau Diamond, has gained recognition in the forex trading community for its unconventional strategy aimed at simplifying the complexities of forex trading. Designed for both beginners and seasoned traders, the system claims to provide consistent returns in all market conditions. This review explores its features, methodologies, and real-world user feedback to give you a balanced assessment of what the system offers.

Understanding the Ez-Forex Trading System

Ez-Forex Trading System 4.2 was created to give traders a consistent and structured approach to forex trading. Unlike more traditional strategies that often rely on trends or specific indicators, this system prioritizes flexibility and performance across different market scenarios.

Synthetic Straddle Strategy

A key innovation of this system lies in its adaptation of the synthetic straddle strategy. Originally used in options trading, straddles profit from significant price swings regardless of direction. Beau Diamond reengineers this approach for the forex market, allowing users to profit from both bullish and bearish moves without having to anticipate the direction. This strategy creates a more neutral risk profile suitable for volatile environments.

Focus on Major Currency Pairs

The system mainly targets major currency pairs, especially the EUR/USD pair. These highly liquid instruments are known for their stability and lower transaction costs. By focusing on these pairs, the system aims to take advantage of recognizable trends and patterns, improving its reliability and profitability.

Key Features of the Ez-Forex Trading System

What sets Ez-Forex Trading System 4.2 apart from other forex systems are its blend of simplicity, adaptability, and practical effectiveness. These features aim to appeal to a wide audience, regardless of experience level.

Adaptability to Market Conditions

One of the hallmark features of the Ez-Forex system is its resilience in both trending and ranging markets. By not depending on a single directional trend, it allows traders to maintain consistent performance, even in erratic or choppy market conditions.

Simplistic Design with Sophisticated Strategy

While the mechanics behind the strategy are advanced, the platform is built with user simplicity in mind. Its intuitive interface and minimal setup make it suitable for traders at all levels. Users don’t need a background in complex analysis to start utilizing the system effectively.

Accessibility and Availability

Beau Diamond has made the system accessible via online sources offering free downloads and community sharing. This allows interested traders to explore the framework with minimal upfront costs and encourages collaboration and feedback within the user community.

How the Ez-Forex Trading System Works

To gauge its value, it’s important to understand the functional logic behind the Ez-Forex system. It operates on identifying specific patterns in major currency pairs to anticipate short-term price action.

Predictable Market Moves

The system relies on identifying three major, commonly repeating price movements. By focusing on these highly probable scenarios, it aims to position traders for high-odds setups based on market rhythm and past behaviors.

Structured Trading Approach

For those with basic forex knowledge, the system provides a step-by-step framework for decision-making. Its structure includes risk management rules and trade guidelines, making it easier to integrate into one’s broader trading methodology.

Profit Generation Amidst Market Fluctuations

The Ez-Forex system is structured to deliver gains even during times of volatility. Because the strategies are not tied to directional predictions, traders are positioned to benefit from rapid market shifts—an advantage especially useful in unpredictable economic climates.

User Experience and Reviews

User feedback for the Ez-Forex Trading System 4.2 varies, though several common themes emerge, particularly around its ease of use and effectiveness in identifying trade opportunities.

Effectiveness in Guiding Profitable Trades

Numerous traders have reported success using the system’s defined entry and exit points. The clarity of its setup helps reduce emotional trading and impulsive decisions, giving especially new traders more confidence in their trades.

User-Friendly Interface

Both beginners and experienced traders have highlighted the system’s clean interface and easy-to-follow instructions. The learning curve is manageable, and many users report being able to get started with little to no prior experience.

Mixed Reviews on Performance

Despite positive outcomes, some users have expressed concerns over inconsistent performance. Variability in individual results may stem from external market conditions or differences in interpretation and execution of the system’s guidelines.

Advantages of the Ez-Forex Trading System

Several benefits make the Ez-Forex Trading System 4.2 an attractive choice for forex enthusiasts who want a repeatable and rules-based strategy.

Comprehensive Strategy

The inclusion of the synthetic straddle technique gives traders the ability to profit in rising and falling markets. This bidirectional strategy reduces the pressure to forecast market movement precisely and expands trading opportunities.

Focus on Liquidity

Trading liquid pairs like EUR/USD enables better trade execution and reduced slippage. These pairs also tend to behave in more predictable patterns, giving the system a strategic advantage in timing and entry.

Educational Components

More than just a trading tool, the Ez-Forex system also includes educational resources aimed at helping users understand its methodology and the basics of forex trading. This added layer helps traders develop long-term skills beyond mechanical execution.

Potential Drawbacks and Considerations

Despite its advantages, the Ez-Forex Trading System is not without limitations. Prospective users should consider the following factors before adopting it into their trading routine.

Market Dependency

Although the system is designed to adapt, it still depends on certain price behaviors. During extreme or irregular volatility, performance may suffer, and users should apply additional risk controls during these times.

Learning Curve

While the system is beginner-friendly, understanding the logic behind the trades takes effort. New users should invest time in learning the core principles before trading real capital.

Variable User Experiences

As with any trading system, results will differ from one user to another. Performance may depend on how faithfully traders follow the rules or how they adapt the system to their own trading environment.

Getting Started with the Ez-Forex Trading System

If you’re considering using the Ez-Forex Trading System 4.2, the steps to begin are straightforward and accessible.

Accessing the System

The system can be found through various websites that allow free download and sharing. This makes it easy for curious traders to try it without financial pressure or long-term commitments.

Learning the Basics

Before applying the system live, users should familiarize themselves with essential forex principles—such as leverage, lot sizing, and order types—to ensure effective application of the strategy.

Practice and Implementation

Traders are encouraged to begin in demo environments or with small real-money trades. Practicing the system in controlled conditions helps build confidence and allows users to understand how it performs in different market settings.

Conclusion

Ez-Forex Trading System 4.2 by Beau Diamond offers a strategic, simplified path into forex trading, especially for those interested in structured, direction-neutral systems. Its core strength lies in the synthetic straddle strategy and emphasis on high-liquidity currency pairs. Although performance may vary and learning is still required, the system provides a solid foundation for both novice and intermediate traders. As always, successful trading depends on continuous learning, disciplined practice, and proper risk management.