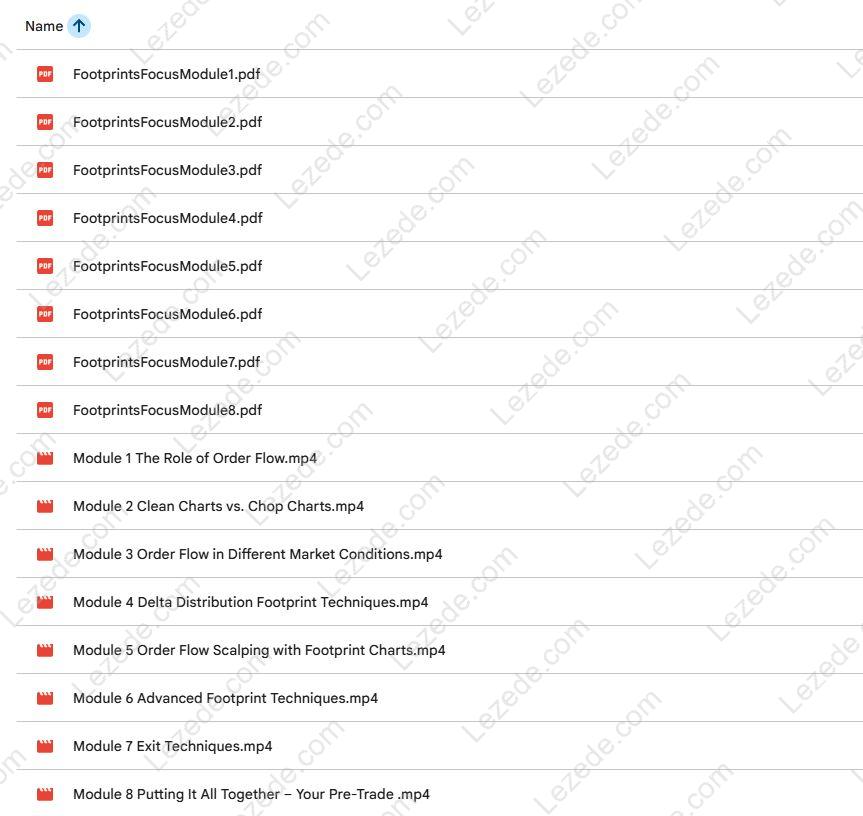

Footprints In Focus Order Flow Trading by Mike Valtos – Includes Verified Content:

Footprints In Focus Order Flow Trading by Mike Valtos – Free Download Video Sample:

PDF Sample – Footprints In Focus Order Flow Trading by Mike Valtos, watch here:

Footprints in Focus: Order Flow Trading by Mike Valtos – A Detailed Review

In today’s competitive trading environment, staying ahead of market movements is essential. One course that stands out is “Footprints in Focus: Order Flow Trading” by Mike Valtos. Designed with precision, this course helps traders unlock the full potential of order flow analysis while offering deep insights into market structure. Whether you’re aiming to sharpen your strategies or deepen your understanding of price action, this course lays out a clear and structured learning journey through its eight specialized modules. Let’s explore what makes this program effective and valuable.

Course Format and Flow

Mike Valtos has segmented his course into eight focused modules, each building logically on the last. This modular structure ensures traders build skills incrementally, avoiding information overload and enhancing practical retention.

Module 1: Introduction to Order Flow Dynamics

The program begins by exploring the fundamental concept of order flow. Valtos breaks down how real-time data reveals institutional behavior through volume spikes and delta surges. By studying these metrics, participants learn how to detect where buying and selling pressure is accumulating.

This module emphasizes reading the behavior of major market participants, allowing traders to align their strategies accordingly. The hands-on guidance enables learners to internalize essential concepts and apply them directly to live market scenarios.

Module 2: Distinguishing Trending from Ranging Markets

Next, the course focuses on identifying trending markets (clean charts) versus consolidating ones (chop charts). Understanding this distinction is vital, as it significantly influences the success of trade setups.

Using real examples and exercises, traders are taught to quickly recognize patterns that differentiate high-momentum conditions from indecisive ones. With this skill, participants can avoid low-probability trades and improve timing.

Module 3: Adjusting to Market Conditions

Here, the course addresses how to adapt trading strategies based on market types—ranging from high volatility environments to quieter sessions. This flexibility is crucial for navigating unpredictable market shifts.

Participants discover how to spot order flow imbalances and implement reactive tactics that adjust to current conditions. The adaptive mindset taught here is essential for traders looking to maintain an edge in ever-changing markets.

Going Deeper with Order Flow Tools

The middle portion of the course transitions into more tactical aspects of order flow trading, equipping students with hands-on methodologies.

Module 4: Analyzing Delta Distribution

This module highlights delta analysis—tracking the divergence between aggressive buyers and sellers. Traders are introduced to mapping delta clusters and interpreting them as potential resistance or support zones.

Understanding these levels enables traders to anticipate future price action and take positions with greater conviction, especially when those levels coincide with institutional footprints.

Module 5: Scalping Strategies Using Footprint Charts

Short-term traders benefit significantly from this module, which dives into scalping techniques using footprint charting. Traders learn how to exploit brief price shifts and manage entries and exits with precision.

Through quick decision-making frameworks and risk-control strategies, participants build confidence in executing rapid-fire trades under tight timeframes.

Advanced Order Flow and Strategy Refinement

In the later modules, the course moves into advanced territory, where traders refine their techniques with more complex setups.

Module 6: Identifying Key Order Flow Patterns

This session uncovers high-probability patterns like absorption, exhaustion, and liquidity surges. Traders learn to identify these advanced signals to gauge when a trend may lose steam or reverse.

Mastering these cues equips participants to position themselves ahead of major moves, improving both entry precision and risk-to-reward ratios.

Module 7: Strategic Exits

Effective exits can be just as important as entries. This module provides a thorough breakdown of exit protocols based on live data, including trailing stop techniques and profit management using order flow metrics.

With these tools, traders reduce emotional decision-making and improve long-term consistency in their performance.

Module 8: Comprehensive Pre-Trade Framework

Bringing all previous lessons together, this final module introduces a structured pre-trade checklist. This process-oriented approach gives traders clarity and confidence before entering any trade.

By synthesizing theoretical concepts with tactical execution, participants complete the course with a well-rounded and executable trading system.

Insights from a Veteran Trader

A standout benefit of this course is the guidance of Mike Valtos himself—a seasoned trader with over two decades of institutional experience at JP Morgan and Cargill. His real-world insights and no-fluff explanations offer learners practical, applicable knowledge they can trust.

His mentorship provides more than just education—it delivers actionable wisdom backed by real trading success.

Affordable, High-Value Education

Priced at just $99, Footprints in Focus is a compelling choice for serious learners. Despite its affordability, the course does not compromise on content quality or depth, making it accessible yet highly beneficial for traders at any experience level.

Final Thoughts

In conclusion, Footprints in Focus: Order Flow Trading by Mike Valtos offers a structured, practical, and in-depth education in one of the most powerful forms of market analysis—order flow. From foundational principles to advanced techniques, the course enables traders to identify institutional actions, evaluate market structure, and execute more confident trades.

Whether you’re starting out or looking to take your trading to the next level, this course delivers the tools, techniques, and mindset necessary for long-term success. As financial markets evolve, learning to interpret order flow could be your competitive advantage.