Free Download Hedged Strategy Series in Volatile Markets by Dan Sheridan

Check content proof, now:

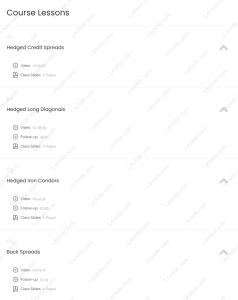

Hedged Strategy Series in Volatile Markets by Dan Sheridan, see what’s included in this course:

Download Hedged Strategy Series in Volatile Markets Free PDF Sample:

Hedged Strategy Series in Volatile Markets by Dan Sheridan: A Comprehensive Review

Trading options in volatile markets can be intimidating, especially when price swings are severe and unpredictable. To address these challenges, Dan Sheridan has developed the Hedged Strategy Series in Volatile Markets, a specialized course aimed at equipping traders with practical tools and robust strategies that perform well under turbulent conditions. This comprehensive program is tailored to help both beginner and seasoned traders develop a solid foundation in risk-managed trading. This review explores the course’s main components, which are delivered through four in-depth sessions, each spotlighting a different hedged trading strategy.

Understanding the Importance of Hedged Strategies

In market environments where price direction is uncertain, hedged strategies become essential for safeguarding capital. These strategies help limit downside risk while still offering opportunities for profit. Sheridan’s course presents critical trading principles that highlight how minimizing losses can be just as important as generating gains. Each session simplifies advanced techniques, making the material accessible without compromising on depth.

The course emphasizes user-friendly, non-directional strategies that can be applied regardless of market direction. This pragmatic structure allows traders to align their strategies with personal risk tolerance and execute trades with more certainty in uncertain conditions. A well-planned hedged strategy can provide a stable path to growth—even during market turbulence.

Session Breakdown: Exploring Each Strategy

The program is divided into four focused sessions, each covering a distinct hedged trading technique. Below is a summary of what you’ll learn in each module:

- Hedged Credit Spreads

- This approach teaches traders how to use credit spreads while implementing hedges to reduce exposure. By layering protection into the position, participants learn how to collect option premiums while limiting their downside. It’s a practical strategy that offers a balanced mix of reward and defense—ideal for unpredictable markets where safety is paramount.

- Hedged Long Diagonals

- This technique leverages the passage of time and volatility protection through well-placed hedges. The strategy utilizes a combination of long and short option positions structured diagonally across expiration dates and strike prices. Through this setup, traders gain an advantage from time decay while controlling risk levels more effectively.

- Hedged Iron Condors

- While iron condors are often associated with flat markets, adding a hedge component turns them into viable tools even during potential volatility spikes. This strategy allows for profit in calm conditions and incorporates protective measures to cushion against unexpected market shifts. Sheridan emphasizes preparedness, showing traders how to manage exposure even when the surface seems quiet.

- Back Spreads

- Best suited for scenarios where large price movements are expected, back spreads are taught with an emphasis on risk mitigation. This setup allows traders to position for sharp market moves while minimizing potential drawdowns. Sheridan shows how to construct these trades carefully, ensuring traders benefit from volatility without taking on excessive risk.

Risk Management Protocols: A Critical Component

A standout feature of this course is its deep dive into risk management. Sheridan, leveraging his tenure at the Chicago Board Options Exchange, shares a wealth of knowledge on preserving capital. Throughout the sessions, he emphasizes actionable methods for identifying, assessing, and mitigating risk—essential skills for any successful trader.

Participants gain access to detailed PowerPoint presentations and structured guidance, helping them understand how to deploy strategies safely. These tools offer clarity on risk control techniques, ensuring that even when markets become chaotic, traders can remain disciplined and informed.

Practical Insights for All Levels of Traders

One of the course’s biggest strengths is its versatility. Whether you’re just starting out or have years of trading experience, the material is designed to be accessible and immediately applicable. Sheridan’s clear teaching style and emphasis on practical steps make advanced strategies easy to digest.

Every concept is broken down into understandable parts, with a strong focus on rules and objectives. This structure encourages learners to take action and build confidence, regardless of their skill level.

Key Takeaways from the Course

-

Risk Control: Learn how to hedge effectively to avoid major losses during market swings.

-

Strategic Variety: Each session delivers unique strategies suited to specific conditions.

-

Hands-On Application: Techniques are geared toward real-time use in live trading.

-

Visual Learning: Slide decks and examples help translate theory into practice.

Conclusion: Empowering Traders for Success

In conclusion, Dan Sheridan’s Hedged Strategy Series in Volatile Markets is a powerful educational tool for traders looking to master risk-adjusted strategies in unpredictable conditions. By focusing on hedged tactics, Sheridan gives participants the tools to stay protected while seeking profit opportunities.

The step-by-step structure allows traders to build confidence in executing advanced strategies, and the course’s emphasis on risk management provides a firm safety net. With Sheridan’s expert instruction and the course’s practical orientation, traders leave better prepared to tackle market volatility with precision and confidence. The insights offered are timeless, offering long-lasting value in a constantly changing trading environment.