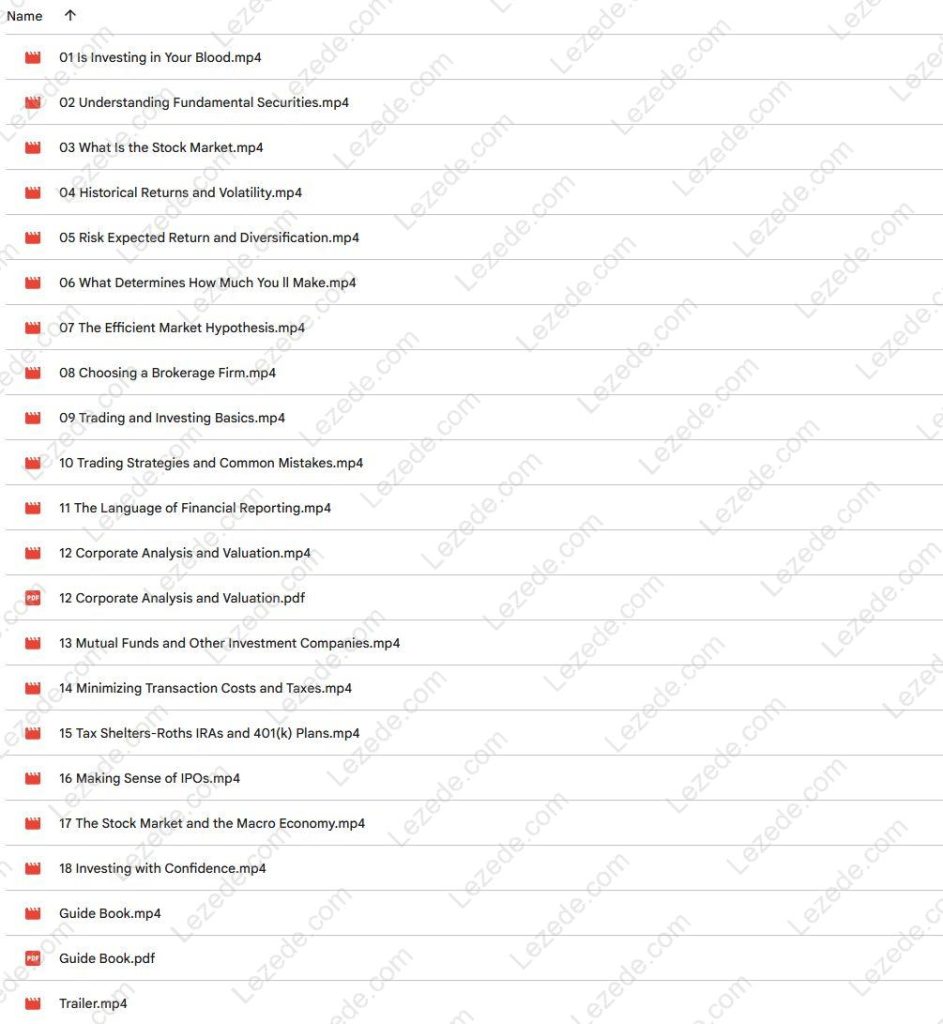

Free Download How the Stock Market Works By Ramon DeGennaro

Check content proof, now:

How the Stock Market Works By Ramon DeGennaro, Free Download Video Sample:

How the Stock Market Works By Ramon DeGennaro, Free Download PDF Sample:

How the Stock Market Works

Gain insight into the rewards and risks of stock investing with a course that reveals why share prices move up and down, and how you can participate in the market without constant worry.

LECTURE

Trailer

01: Is Investing in Your Blood?

Start by distinguishing between trying to outperform the market and simply participating in it. One path carries heavy risk, while the other provides a safer approach. Explore the natural human tendency to search for patterns—and ask the key question: are stock returns truly predictable?

33 min

02: Understanding Fundamental Securities

Discover how stocks stem from straightforward business arrangements. Use a clever analogy to differentiate between stocks and bonds. Both allow people to share in a company’s resources and income, but they operate in fundamentally different ways.

31 min

03: What Is the Stock Market?

Although today’s stock markets are increasingly high-tech, at their core they function much like everyday markets—such as those for groceries or cars. With this comparison in mind, explore the unique features that make stock markets work.

29 min

04: Historical Returns and Volatility

Examine the tradeoff between risk and reward in stock investing. Review the long-term average return of a broad stock portfolio spanning decades, then shift to the short-term fluctuations that often make investors uneasy.

31 min

05: Risk, Expected Return, and Diversification

Consider the timeless question: do you prefer to dine well, or sleep well? Test your own risk tolerance through simple role-playing exercises, and then evaluate strategies that spread risk while boosting long-term chances of success.

30 min

06: What Determines How Much You’ll Make

Study the essential formula behind investing: compounding earnings. Focus on the three factors that influence your final outcome. Many investors worry about the one element beyond their control, rather than focusing on what truly matters.

29 min

07: The Efficient Market Hypothesis

Review evidence showing that consistently outperforming the market is difficult even for professionals. The efficient market hypothesis suggests that prices generally reflect fair value, leaving few true bargains. Weigh the scenarios and research that support this perspective.

29 min

08: Choosing a Brokerage Firm

Explore the process of selecting a brokerage, which can range from filling out an online form to carefully comparing multiple firms. Assess your personal needs while clearing up common myths about brokers and their role.

30 min

09: Trading and Investing Basics

Learn how trades are actually executed, and discover how to place customized orders. By setting buy or sell conditions in advance, you can reduce emotional, impulsive decisions. Also, gain an introduction to the concept of short selling.

31 min

10: Trading Strategies and Common Mistakes

Survey practical trading approaches while identifying common errors like overconfidence, confirmation bias, and fear of loss. Finally, enter the intriguing realm of options trading and when their use might be advantageous.

30 min

11: The Language of Financial Reporting

Demystify financial reports by analyzing the three key corporate documents: the balance sheet, income statement, and cash flow statement. Think of them as parallels to a mortgage form, a tax return, and a personal bank statement.

30 min

12: Corporate Analysis and Valuation

Advance into corporate finance by exploring different valuation techniques. Examine metrics like price-to-earnings, book value, and liquidation value—understanding both their benefits and their limits. Along the way, master terminology frequently heard in financial news.

33 min

13: Mutual Funds and Other Investment Companies

Investigate the remarkable rise of mutual funds, a hallmark of financial innovation. Compare actively managed funds with index funds, and see how mutual funds stack up against exchange-traded funds (ETFs).

32 min

14: Minimizing Transaction Costs and Taxes

Learn tactics to reduce transaction expenses and taxes, thereby boosting investment returns. Embrace two proven mantras: (1) frequent trading hurts performance, and (2) cut your losses while letting winners grow.

31 min

15: Tax Shelters—Roths, IRAs, and 401(k) Plans

Examine tax-advantaged accounts that benefit all investors, not just the wealthy. Traditional IRAs, Roth IRAs, and 401(k)s offer unique tax savings. Review the requirements and perks of each option.

33 min

16: Making Sense of IPOs

Dive into the world of initial public offerings—glamorous yet unpredictable stock market events. Understand how investment banks set IPO prices, and then see how market forces often push those values in unexpected directions.

31 min

17: The Stock Market and the Macro Economy

Analyze how national and global economic trends affect stock performance. Consider strategies during recessions—can losses be avoided? Also, review the role of the Federal Reserve and whether its policies should matter to you.

31 min

18: Investing with Confidence

Conclude by evaluating your personal financial situation to decide how much to invest and how to distribute assets in a balanced portfolio. With a solid grasp of market mechanics, you’re ready to put your knowledge into action.

31 min

DETAILS

Overview

Learn how to potentially increase your wealth and avoid making expensive mistakes with How the Stock Market Works. Professor Ramon P. DeGennaro, an award-winning professor in banking and finance at The University of Tennessee, Knoxville, leads you through 18 detailed lectures that explain the stock market from the inside, introducing you to the factors that make company stocks rise and fall and the information you need to grasp the market’s role in the world economy, evaluate the relative soundness of stocks, and understand the stock investment options available to you.

About

Ramon P. DeGennaro

I like teaching things that will let people solve problems for the next 50 years, and if something can be automated, then I don’t want to teach it.

Dr. Ramon P. DeGennaro is the CBA Professor in Banking and Finance at The University of Tennessee, Knoxville. In addition, he consults in the areas of business valuation, investments, and financial management and is a Luminary Member of the Angel Capital Group. He also served as a Visiting Scholar at the Federal Reserve Banks of Cleveland and Atlanta and for the American Institute for Economic Research. Professor DeGennaro holds a Ph.D. in Finance from The Ohio State University. At The University of Tennessee, Professor DeGennaro has been nominated for the Allen H. Keally Outstanding Teacher Award, the John B.

Ross Outstanding Teaching Award (three times), and the College of Business Outstanding Teaching Award. Professor DeGennaro has presented original research at dozens of professional conferences, and he is the recipient of more than 50 research and professional development grants. His current research involves investments, financial markets, and entrepreneurship. He has published more than 40 refereed articles on investments, financial market volatility, small-firm finance, the term structure of interest rates, financial institutions, and prediction markets. He also has written research reports, book chapters, book reviews, and several Federal Reserve publications.

REVIEWS

Bug227

Informational

Even if you are not a newbie to the stock market I believe that you can learn something from these lectures. He is very concise with his words and It never hurts to review information you may already know. This course is definitely tailored toward beginners but honestly has a lot of useful information for just knowledge sake.

StockCarRacing

Great for Novices

I realized right away that this course is for complete newbies to stock investing but there’s always something to learn. There’s some good information about index & mutual funds as well as ETFs. And in order to give it a fair hearing I went through the whole course. Professor DeGennaro keeps it down to earth and clear. The presentation is mildly amusing and non-threatening.