How to Code a Volume/Market Profile and TPO by Ninja Coding

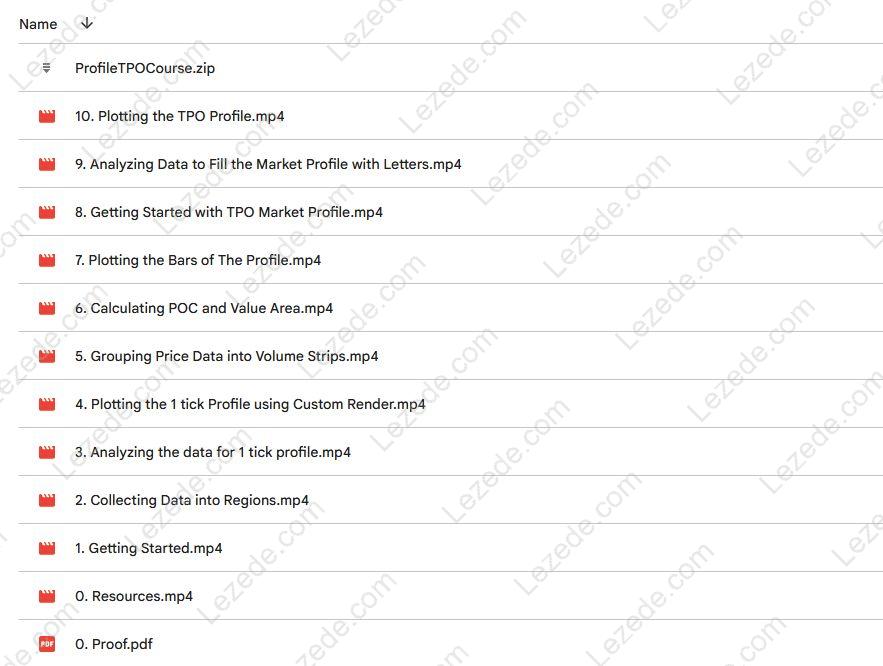

Check Proof of Content here:

How to Code a Volume/Market Profile and TPO by Ninja Coding – Free Download Video Sample:

How to Code a Volume/Market Profile and TPO by Ninja Coding – Watch Content Proof here:

Comprehensive Review: How to Code a Volume/Market Profile and TPO by Ninja Coding

In the fast-evolving world of trading, a deep understanding of market behavior is key to smarter decision-making. Among the many tools available, the integration of Volume Profile and Time Price Opportunity (TPO) stands out. These tools help traders visualize how price interacts with volume and identify key levels where the market has spent significant time. If you’re just starting with coding in NinjaTrader 8 or seeking to improve your scripting capabilities, this guide is tailored for you. We will walk through the process of coding a Volume/Market Profile and TPO with practical steps and actionable insight. By the end, you’ll be well-equipped to create a refined, data-driven trading tool.

Getting Started

Before jumping into the coding side, it’s important to establish a solid grasp of Volume Profile and TPO fundamentals. Volume Profile illustrates the volume traded at different price levels during a specific period, offering a clearer view of support and resistance zones. Understanding this relationship between volume and price gives context to price fluctuations.

The Time Price Opportunity (TPO) concept complements Volume Profile by tracking the duration that price levels remain active. This allows traders to identify price areas that attract prolonged trading activity, offering further insight into market structure. Combining these elements in your script strengthens your market view and enriches your trading logic.

Data Collection

Once the foundational knowledge is set, the next critical step is gathering raw market data. You’ll need to capture pricing information across defined intervals—tick data is most preferred for its accuracy in reflecting real-time market conditions.

This data must be organized in a logical format that enables easier manipulation and analysis. The more granular your input—whether second-by-second or over larger intervals—the more detailed your resulting profile becomes. A standard table format might look like this:

| Time Interval | Price Level | Volume |

|---|---|---|

| 09:00 – 09:01 | $100.00 | 500 |

| 09:01 – 09:02 | $101.00 | 700 |

| 09:02 – 09:03 | $100.50 | 300 |

This format serves as the core dataset for calculating metrics such as Point of Control (POC) and Value Area (VA), which are key to meaningful volume profiling.

Profile Calculation

The next phase involves analyzing the collected data through custom logic. You’ll want to script functions that calculate POC (the price with the highest volume) and VA (the price range covering 70% of the total volume).

Here’s a simplified breakdown:

-

Total Volume: Aggregate volume from all intervals.

-

POC: Identify the price level with the maximum volume.

-

VA: Define the range where 70% of total volume resides.

These metrics help traders pinpoint levels where price is most accepted or rejected, shaping their strategy with stronger conviction.

Custom Rendering

After implementing the calculation logic, the goal is to visualize the data effectively. NinjaTrader supports graphical rendering, which lets you transform raw numbers into intuitive visuals like histograms and TPO letter plots.

Determine how you’d like to present the profile:

-

Colored Segments: Highlight different volume levels with varying colors.

-

Histograms: Straightforward vertical bars representing volume per price.

-

Letter Format: Used in TPO to show how long price remained at a level.

These formats allow for faster interpretation of market activity, enabling quick reactions and analysis during trading hours.

Implementing Volume Strips

To further improve clarity, incorporate volume strips into your chart. These horizontal bars display volume intensity across price ranges and help segment the data visually.

For coding volume strips, consider:

-

Defining strip width based on volume.

-

Applying contrasting colors for visibility.

-

Including toggles for users to switch views or layouts.

These visual cues help traders immediately identify areas of interest, improving decision-making efficiency.

Fine-tuning Features

To create a more interactive tool, enhance the user experience with adjustable settings:

-

Change the granularity of volume/tick size.

-

Select custom time frames.

-

Switch between Volume and TPO views.

-

Modify the percentage range for VA calculations.

The more customizable your tool, the more traders will find value in adapting it to their specific strategies and market preferences.

Testing and Validation

Before deploying your custom profile tool, rigorous testing is a must. Validate that calculations like POC and VA are accurate and hold up across different datasets and market scenarios.

Testing tips include:

-

Verifying POC logic across various sessions.

-

Confirming VA includes roughly 70% of volume.

-

Evaluating graphical output for accuracy and clarity.

-

Gathering user input for usability and performance tweaks.

This ensures your final product is both reliable and insightful for day-to-day use.

Conclusion

To sum up, building a coded Volume Profile and TPO tool in NinjaTrader 8 can significantly enhance a trader’s edge in the market. These techniques bring structure and clarity to price movement, empowering better trade decisions. Leveraging resources such as coding tutorials, trading forums, and expert-led courses can further speed up your development. With consistent practice and a deepening understanding of market behavior, you’ll be able to craft a powerful trading tool that aligns with your unique strategy.