Infinite Scaling In/Out Strategy Framework by Ninja Coding

Check Proof of Content here:

Infinite Scaling In/Out Strategy Framework by Ninja Coding – Watch Content Proof here:

Infinite Scaling In/Out Strategy Framework by Ninja Coding: A Comprehensive Review

In today’s dynamic trading environment, mastering order execution is crucial for consistent results. The Infinite Scaling In/Out Strategy Framework developed by Ninja Coding is a specialized tool crafted for NinjaTrader 8 users. It focuses on precise order control and structured trade management, enabling traders to scale into and out of positions with minimized risk. This solution is particularly beneficial for both beginners and experienced traders looking to sharpen their execution strategies and enhance their performance.

Understanding the Framework

Central to the strategy is a focus on individualized order control and risk management. The framework empowers traders to handle multiple entries and exits efficiently, distributing risk in a calculated manner. This becomes especially important when implementing advanced strategies with several stop-loss points and profit targets. It brings structure and clarity to the often complex world of position scaling.

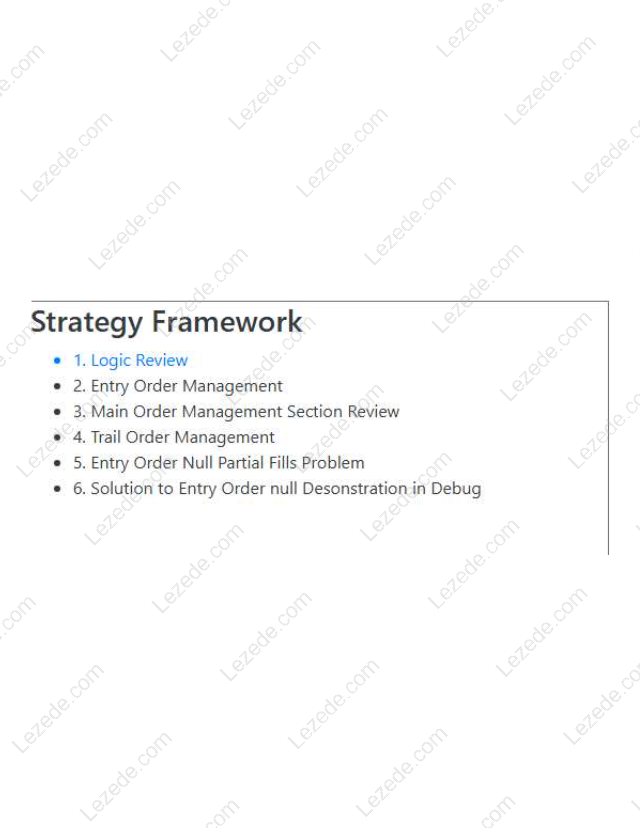

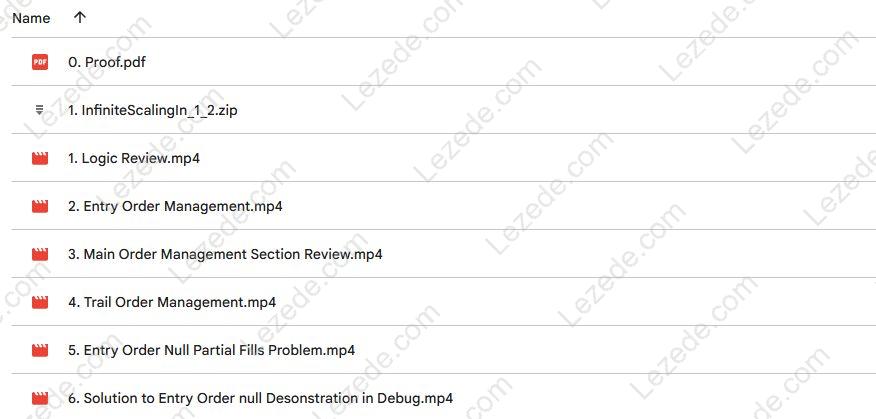

The course is organized into critical learning components to ensure traders can apply the material effectively:

-

Logic Review: Breaks down the principles behind scaling trades, offering a clear understanding before progressing to deeper techniques.

-

Order Management: Teaches essential skills for managing diverse positions and execution styles with precision.

-

Entry and Exit Management: Offers practical guidance on placing orders and managing exits based on varying market behaviors.

Comprised of six streamlined lectures, the framework promotes efficient learning without sacrificing depth. This design ensures accessibility while delivering actionable trading strategies to users of all experience levels.

Practical Examples and Techniques

What sets this framework apart is its use of applicable, real-world trading examples. It showcases how to automate profit target management using predefined signals—removing the need for manual input and increasing trading efficiency. By naming signals, traders can link target strategies to specific entries, streamlining trade workflows.

Another major benefit is its approach to managing partial fills. These scenarios can hinder profitability, but the framework teaches how to dynamically adjust stops after a target is hit—resulting in smoother and more profitable trade execution.

Highlights at a Glance:

-

Clear Logic Overview: Strong foundation for understanding scaling techniques.

-

Advanced Order Handling: Optimizes execution of multiple trades.

-

Flexible Entry/Exit Strategy: Adapts to different market conditions.

-

Automation Tools: Reduces manual workload by auto-adjusting targets.

-

Problem Solving Tools: Offers effective solutions for execution challenges.

The Learning Experience

The Infinite Scaling In/Out Framework emphasizes clarity and application. Each lesson is concise yet rich in content, delivering skills that translate directly to trading performance. Its format avoids the overwhelm of dense courses, making it easier for learners to retain and apply what they learn.

Ninja Coding skillfully merges theoretical instruction with real-time trading applications. The hands-on style ensures learners quickly gain confidence and proficiency. Regardless of learning preference, the intuitive course design supports clear understanding and smooth execution of even advanced strategies.

Student feedback highlights how accessible the lessons are—even for those new to trading. The visual aids and real examples enhance retention and foster a more immersive learning journey.

Versatile for All Trader Levels

A key advantage of this framework is its adaptability across experience levels. New traders can grasp the fundamentals of structured trade management, while experienced traders benefit from refining their edge and incorporating more nuanced techniques into their setups.

Its emphasis on flexible, analytical thinking equips traders to handle shifting market conditions. As users progress through the content, they develop a responsive, strategy-driven mindset—critical in volatile markets.

Benefits Across Experience Levels:

For New Traders:

-

Lays down strong foundational skills.

-

Builds confidence with guided learning.

-

Simplifies complex ideas using visuals and examples.

For Seasoned Traders:

-

Sharpens existing systems and processes.

-

Introduces time-saving automation techniques.

-

Improves adaptability to market volatility.

Overcoming Challenges with the Framework

Trading involves overcoming many obstacles—and this framework prepares traders with tactical solutions. Beyond teaching theory, it emphasizes actionable techniques to reduce pain points, such as execution delays and emotional trading errors.

One major concern in active trading is the stress of managing positions in real-time. This strategy addresses that by allowing automation of stop-loss changes after target hits, allowing traders to stay on track without constant monitoring.

Additionally, by establishing a systematic process for order handling and risk exposure, the framework helps reduce emotionally driven decisions. With a clearer trading routine, traders often experience better performance and greater confidence.

Conclusion: A Resource for Trading Mastery

Overall, the Infinite Scaling In/Out Strategy Framework by Ninja Coding is a comprehensive toolkit for anyone seeking to optimize order management and execution strategies. With its structured yet accessible approach, it empowers traders to manage risk, scale efficiently, and streamline their processes.

From foundational theory to advanced techniques, the framework equips traders with the insights and tools needed to navigate the markets more confidently. Whether you’re beginning your trading path or refining your current methods, this program is a valuable resource for building a smarter, more efficient trading practice.