Free Download Iron Condors Deep Dive by Dan Sheridan

Check content proof, now:

Iron Condors Deep Dive Free Video Sample:

Instant Download Iron Condors Deep Dive, see what’s included in this course:

Iron Condors Deep Dive by Dan Sheridan Free PDF Sample:

Iron Condors Deep Dive: A Comprehensive Review of Dan Sheridan’s Course

Navigating the landscape of options trading can be daunting, particularly for those just starting out. Fortunately, Dan Sheridan—a veteran in the trading world—offers clarity through his course, “Iron Condors Deep Dive.” With structured instruction and detailed guidance, this program demystifies complex strategies like iron condors. It provides deep analysis and clear, actionable takeaways, making it a solid choice for traders aiming to fine-tune their approach. By the end of this review, you’ll gain a comprehensive understanding of the course content and how it could enhance your trading results while controlling risk exposure.

Course Overview

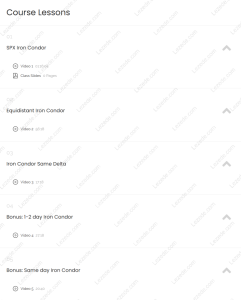

Designed to provide a strong foundation in iron condor trading, Iron Condors Deep Dive delivers about three hours of educational video along with nearly 25 PDF slides as supporting materials. Dan Sheridan covers crucial topics throughout, such as how market volatility (VIX) influences iron condors, how to assess trade probability and expected movement, and how iron condors stack up against alternative strategies like put credit spreads.

Content Breakdown

- Exploring the VIX:

The course offers a deep dive into the Volatility Index, giving participants a clear view of how market volatility plays a critical role in the performance of iron condors. Understanding this relationship is vital for making strategic decisions in different market conditions. - Probability and Forecasting Moves:

Advanced discussions on projecting expected price movement help form a theoretical base for traders to anticipate potential outcomes when deploying iron condor strategies. - Strategy Comparisons:

- Iron Condors vs. Put Credit Spreads:

Dan provides a thoughtful comparison between these two popular strategies, outlining their pros and cons. This section empowers traders to choose based on their individual risk profiles and trading goals.

- Iron Condors vs. Put Credit Spreads:

Visual Learning Aids

The accompanying slides enhance comprehension by visually summarizing key principles. They simplify intricate ideas into digestible elements, aiding long-term retention and practical application.

Trading Strategies Explored

A major strength of this course is its thorough breakdown of iron condor-based strategies. Participants are not only guided through trade setups but also through risk management and exit techniques—key components for improving trading effectiveness.

Key Elements of the Course

- Defining Strike Widths:

You’ll learn how to properly set the width between strike prices to balance risk and reward. This parameter plays a major role in the strategy’s overall success. - Best Trading Instruments:

The program highlights which trading vehicles are most appropriate for iron condor implementation. This helps traders make informed decisions when selecting assets. - Sheridan’s Five Core Criteria:

A standout section, this covers Dan’s personal checklist for evaluating trade setups. These five factors provide a consistent and disciplined framework for making smarter trade decisions.

Real-World Examples

The inclusion of real trade case studies is a vital element of this course. These examples demonstrate how theory is applied in live market conditions, giving traders practical context for the concepts they’ve learned.

Advanced Strategies

For those seeking more complex methods, the course dives into next-level techniques such as spaced-out condors and ultra-short-term (same-day) trades. These can be highly effective under the right circumstances and provide additional tools for strategy diversification.

Space and Timing

- Wider Strike Spacing:

This method seeks to take advantage of broader price fluctuations. While it offers more room for profit, it also comes with unique risks and demands closer attention. - Iron Condors for Same-Day Trades:

This section is crucial for those interested in intraday opportunities. It emphasizes swift analysis and decision-making—skills vital for short-term strategy execution.

Bonus Content

Additional videos focus on one- and two-day iron condor setups, offering more techniques and tips. This bonus material further deepens the course value and reinforces what has already been taught.

Suitability for Every Trader

Dan Sheridan’s course is accessible for beginners and beneficial for advanced traders alike. This broad appeal ensures that participants of various experience levels can gain meaningful insights.

For Beginners

Newcomers will appreciate the methodical structure that breaks down difficult topics into easy-to-follow segments. The course equips them with essential tools to begin trading options with confidence.

For Experienced Traders

Veteran traders will benefit from the course’s nuanced discussion of risk control, trade exits, and sophisticated strategies. Sheridan’s seasoned perspective adds depth to these lessons, making them highly applicable to real-world scenarios.

Conclusion

Overall, Iron Condors Deep Dive by Dan Sheridan is a robust educational tool for mastering iron condor strategies. By focusing on critical concepts like volatility, expected movement, and risk techniques, the course provides a well-rounded and actionable framework for traders at all stages. The added bonus materials enhance the learning journey, making this course a standout option for those looking to elevate their options trading expertise. Whether you’re building a solid foundation or refining advanced tactics, this program serves as a powerful step toward reaching your financial objectives through trading.