Mastering the Gaps – Trading Gaps Free Download – Includes Verified Content:

Mastering the Gaps: A Comprehensive Review of Gap Trading

Financial markets present countless opportunities for those who understand how to identify and act on them. One trading style that continues to gain traction is gap trading — a technique that enables traders to profit from sudden price jumps or drops that occur between candlestick sessions. The Mastering the Gaps course was created for traders who want to specialize in this area. Balancing theory with real-world examples, it serves as a structured pathway for anyone aiming to sharpen their trading expertise.

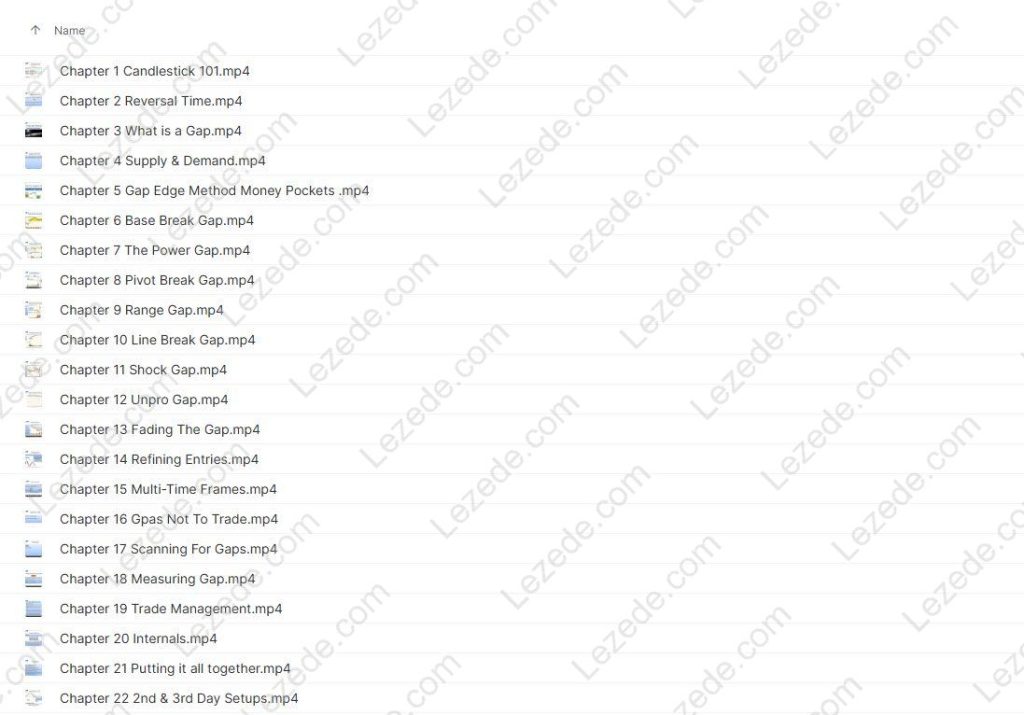

This program delivers over eight hours of step-by-step training across 23 chapters, giving learners the flexibility to progress at their own pace. With a focus on practical application, participants are taught how to detect, evaluate, and trade gaps with greater precision.

What Are Price Gaps? Definition and Categories

Price gaps are empty spaces on a chart where no trades occurred, usually between the prior session’s close and the next session’s open. They typically reflect a change in sentiment caused by news, earnings, or macroeconomic updates. Interpreting these correctly is essential for effective gap trading.

The course outlines four main types:

-

Common Gaps: Occur often and are usually filled quickly without signaling strong sentiment.

-

Breakaway Gaps: Mark the start of a new trend, often confirmed by volume.

-

Continuation (Runaway) Gaps: Appear mid-trend, suggesting momentum is intact.

-

Exhaustion Gaps: Found near the end of a trend, hinting at a potential reversal.

Learning to distinguish these equips traders to forecast price behavior more effectively.

Trading Approaches: Gap and Go, Gap Fill, Fading the Gap

Three core strategies are taught in detail:

-

Gap and Go: Entering in the direction of the gap right after market open. High volume serves as confirmation.

-

Gap Fill: Anticipating that price will retrace back to the prior close. This requires recognizing signs of mean reversion.

-

Fading the Gap: Taking trades against the gap direction, betting on a reversal. This carries higher risk but can be profitable with strong signals.

Strategy Comparison at a Glance

-

Gap and Go: Momentum-based, medium-to-high risk, best with strong opening volume.

-

Gap Fill: Moderate risk, effective when reversal signs are present.

-

Fade the Gap: High risk, suitable only with reliable reversal indicators.

Tools and Indicators for Successful Gap Trading

To trade gaps effectively, several tools are emphasized:

-

Moving Averages to spot trends and confirm direction.

-

Volume Analysis since strong gaps usually appear with heavy trading activity.

-

Pre-Market Scanners to highlight stocks with unusual pre-market behavior.

The course also stresses risk management — stop-losses, position sizing, and capital protection — as gaps can create highly volatile setups.

Where Do Gaps Appear Most Often?

Gaps are common in equities, where trading pauses overnight and major announcements can cause sharp moves. They are less frequent in forex, which trades 24/5, reducing the chances of sudden gaps. The program explains these market differences to help traders set realistic expectations.

The Psychology of Gap Trading

Technical skills alone aren’t enough — trading gaps demands emotional resilience. Because volatility can trigger fear or greed, traders must remain disciplined. The course highlights the importance of sticking to a plan, avoiding impulsive decisions, and maintaining composure under pressure.

The Importance of Discipline

-

Build a Plan: Define entries, exits, and risk rules.

-

Emotional Control: Recognize emotional triggers and stay rational.

-

Ongoing Learning: Adapt to market shifts and refine strategies.

Conclusion

The Mastering the Gaps course offers a well-rounded education on gap trading for traders of all levels. By blending definitions, strategy breakdowns, risk management principles, and psychological training, it equips learners to take advantage of the unique opportunities gaps present. More than just a technical guide, it also builds the mindset and discipline needed to succeed in today’s fast-changing markets.