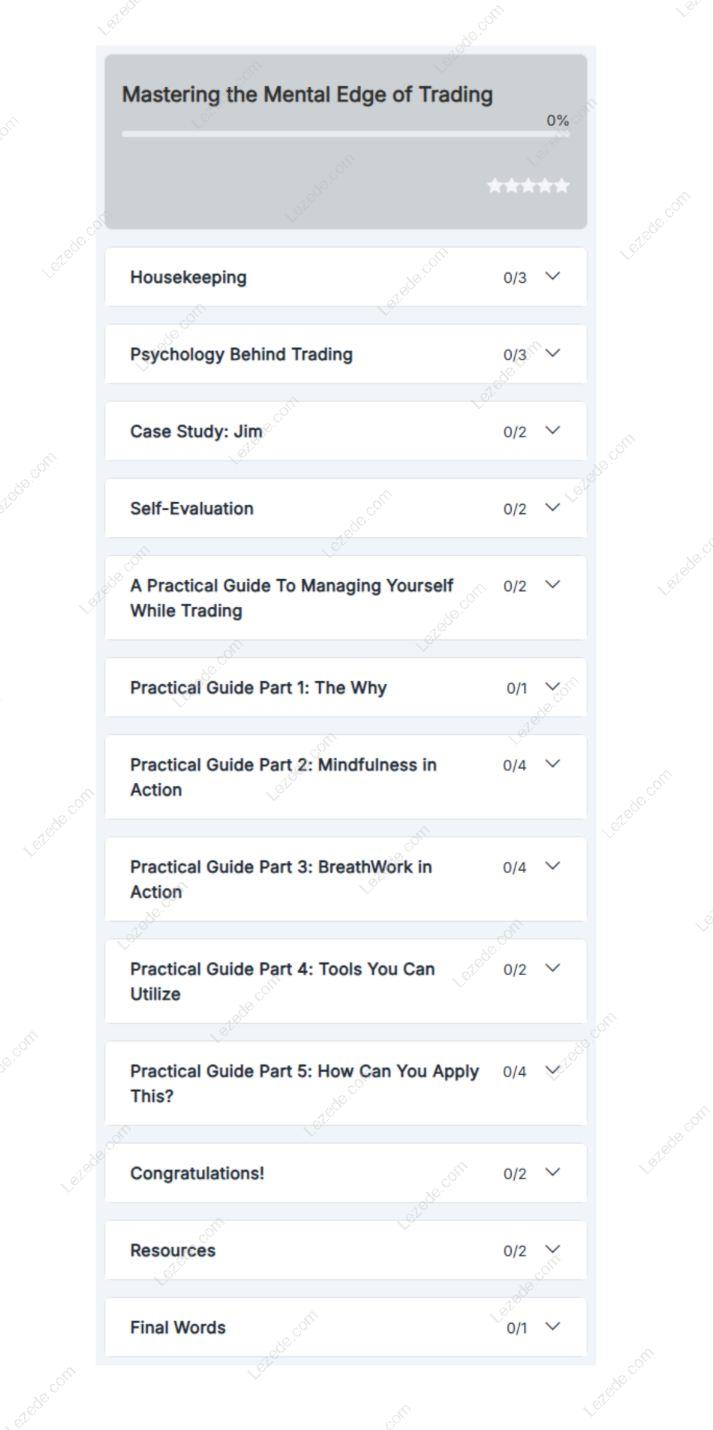

Free Download the Mastering The Mental Edge Of Trading by Emmanuel Osahon – Includes Verified Content:

Mastering the Mental Edge of Trading: A Comprehensive Review

Mastering The Mental Edge Of Trading – Watch Content Proof here:

PDF Sample – Mastering The Mental Edge Of Trading, watch here:

Introduction: Why Trading Psychology Matters

In the intricate world of trading, success is not only about technical skills, charts, or strategies — the mental game plays a critical role. “Mastering the Mental Edge of Trading” by Emmanuel Osahon sheds light on how mental resilience and psychological mastery separate top traders from the rest. This review explores the key psychological concepts Osahon presents, offering practical insights for traders at every level.

Understanding the Psychological Landscape of Trading

Osahon emphasizes that trading performance is deeply influenced by one’s mental state. He advocates for mindfulness, deep breathing, and visualization techniques as tools to maintain calm and focus amid market volatility. These practices help traders stay present, reduce anxiety, and make better decisions.

Importantly, Osahon argues mental preparation is foundational—without it, even the best strategies may fail in execution. By mastering emotional regulation, traders unlock the ability to perform consistently.

Key Psychological Themes Explored

-

Motivation: Osahon discusses two forms of motivation — moving toward profits versus moving away from losses. Successful traders find a balance between these drives, avoiding overconfidence and excessive risk aversion.

-

Self-Awareness: Recognizing internal thought patterns (“meta programs”) helps traders understand how subconscious beliefs shape their actions. Adjusting these patterns fosters a growth mindset and better-aligned trading behaviors.

-

Resilience and Discipline: Creating daily routines that integrate strategy with mental state management builds the discipline needed to weather trading’s ups and downs.

The Performance Process Cycle

A standout concept in the book is the Performance Process Cycle, which includes four phases:

-

Being: Grounding oneself in the present to prepare mentally for trading.

-

Production: Efficiently analyzing and executing trades.

-

Performance: Reviewing outcomes to learn what worked.

-

Letting Go: Releasing emotional attachment to trades to avoid negative carryover.

This cycle encourages systematic improvement and emotional balance.

Why This Book Is a Must-Read for Traders

-

Holistic Approach: Combines strategy with essential mental skills for real-world success.

-

Actionable Exercises: Practical methods to cultivate self-awareness and discipline.

-

Applicable for All Levels: From novices struggling with emotional control to veterans seeking mental edge refinement.

Conclusion: Master Your Mind, Master the Market

Emmanuel Osahon’s Mastering the Mental Edge of Trading transcends traditional trading guides by focusing on the crucial psychological factors impacting performance. It offers a roadmap to build emotional resilience, sharpen decision-making, and create sustainable trading habits.

For anyone serious about trading, this book is an invaluable resource to develop the mental toughness required to thrive in volatile markets. Embracing Osahon’s principles can transform your trading approach—making you a smarter, more confident, and ultimately more successful trader.