Robotic trading interactive, Free download Proof of content:

Robotic trading interactive – Free Download Video Sample:

Robotic trading interactive – Watch Content Proof here:

PDF Sample – Robotic trading interactive, Watch here:

Robotic Trading Interactive: Transform Your Trading with IBKR Automation

Experience the next level of trading with Robotic Trading Interactive powered by Interactive Brokers (IBKR). This advanced, fully automated trading solution allows you to execute strategies across multiple asset classes—stocks, forex, crypto, futures, and options—using algorithmic intelligence. Say goodbye to emotional trading and welcome the era of smart, consistent decision-making.

Why Robotic Trading Interactive with Interactive Brokers?

Interactive Brokers offers:

-

A robust API that supports real-time data, multi-asset execution, account management, and seamless integration with coding languages like Python, Java, C++.

-

High-performance execution: millisecond trade entries, low latency, and scalable infrastructure.

-

Comprehensive backtesting tools: simulate strategies on historical data to refine effectiveness and control risk.

These features enable you to build and deploy trading bots with confidence, backed by IBKR’s proven technology.

Benefits of Automated Trading

Emotion-Free Execution

Robotic trading eliminates impulsive decisions—no more fear or greed. Your strategies follow predefined criteria consistently, ensuring reliable performance.

Increased Trade Volume & Cost Savings

Automated setups can execute multiple small orders daily, reducing slippage and taking advantage of IBKR’s low commissions. Over time, this approach yields significant cost efficiency.

Backtesting and Optimization

Test your algorithms using historical market data to:

-

Determine win rate, max drawdown, and risk metrics

-

Tweak parameters to enhance consistency

-

Evaluate performance in different market regimes

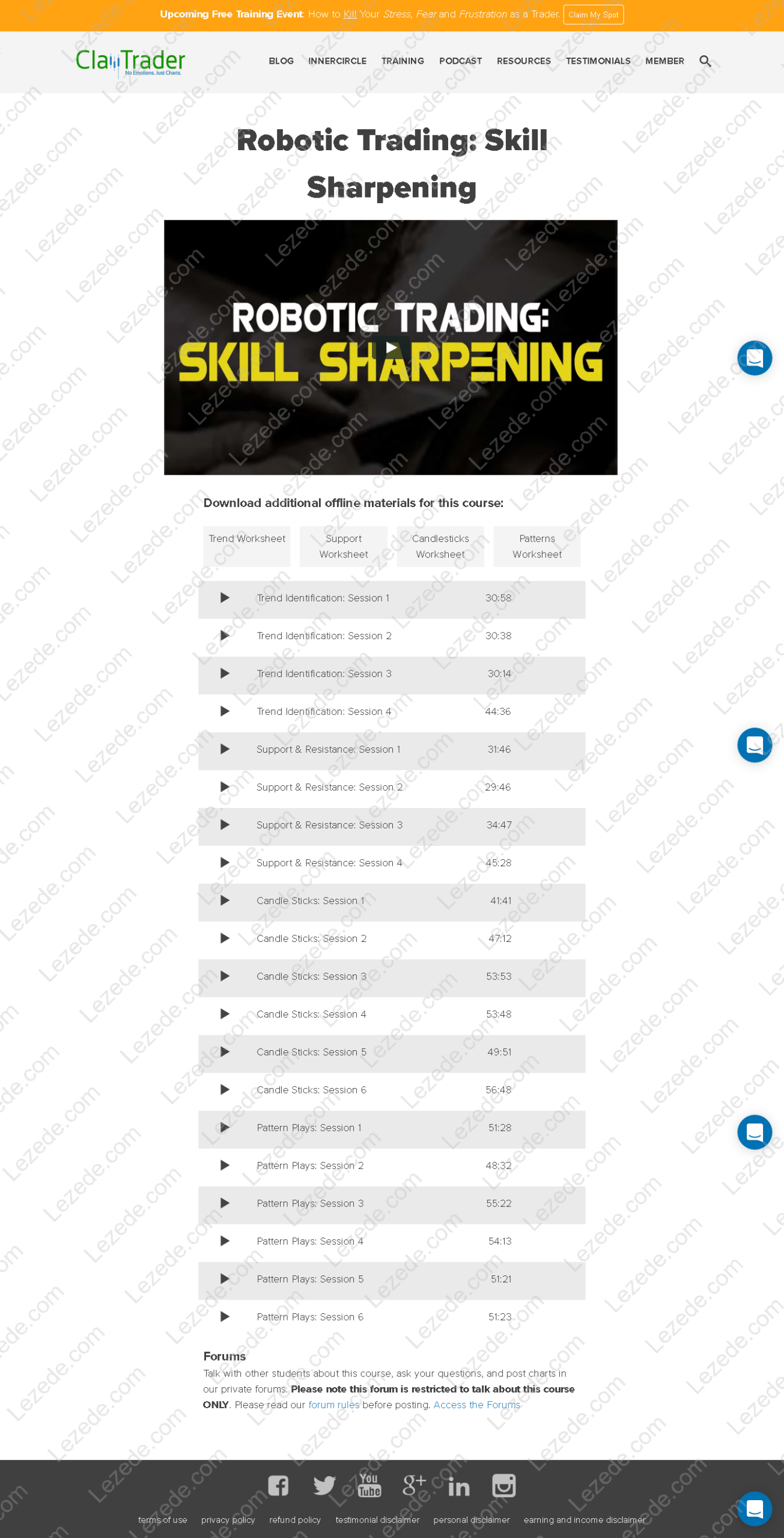

The “Robotic Trading: Skill Sharpening” offer from ClayTrader highlights the importance of education and simulated testing claytrader.com.

Advanced Risk Controls in Robotic Trading Interactive

IBKR’s automation framework enables setting:

-

Hard stop-loss and profit-target triggers

-

Portfolio-level exposure limits

-

Real-time risk monitoring with dynamic adjustments

These features ensure your bot can exit a position based on preconfigured boundaries, protecting capital in volatile markets.

Accessibility & Education – Even for Beginners

While algorithmic trading requires coding, Interactive Brokers and partners like ClayTrader provide:

-

Extensive video courses, PDFs, and guides for learning trading bots

-

Community support and code examples to help launch your first strategy

-

Lifetime access to educational materials for ongoing growth

Real-Time Monitoring & Strategy Adjustments

You retain control with:

-

Dashboards showing profitability, drawdown, and execution stats

-

The ability to pause, tweak, or enhance algorithms live

-

Detailed logs for trade-by-trade performance analysis

This hybrid approach blends automated speed with human oversight.

Ready to Take Control?

With Robotic Trading Interactive through Interactive Brokers, you’ll unlock:

-

24/7 execution capabilities

-

Consistent application of your best strategies

-

Leaner costs and reduced manual effort

Paired with comprehensive education and community backing from providers like ClayTrader, you’re equipped to trade smarter, not harder.