Free Download Seven Trading Systems Education Course by Capstone Trading – Content Proof:

Seven Trading Systems Education Course Free Video Sample:

Seven Trading Systems Education Course Free Download, see the proof of what’s inside here:

Seven Trading Systems Education Course Free PDF Sample:

In-Depth Review of the Seven Trading Systems Education Course by Capstone Trading

Navigating today’s dynamic trading environment demands not just experience, but a strong foundation in strategy and adaptability. The Seven Trading Systems Education Course from Capstone Trading delivers a structured and practical learning experience focused on trading e-mini S&P futures—especially using gap trading techniques. What makes this course stand out is its hands-on approach and inclusion of open-source trading system code, which appeals to beginners and seasoned traders alike. This review takes a close look at the course’s structure, strategic content, ongoing updates, and its real-world value.

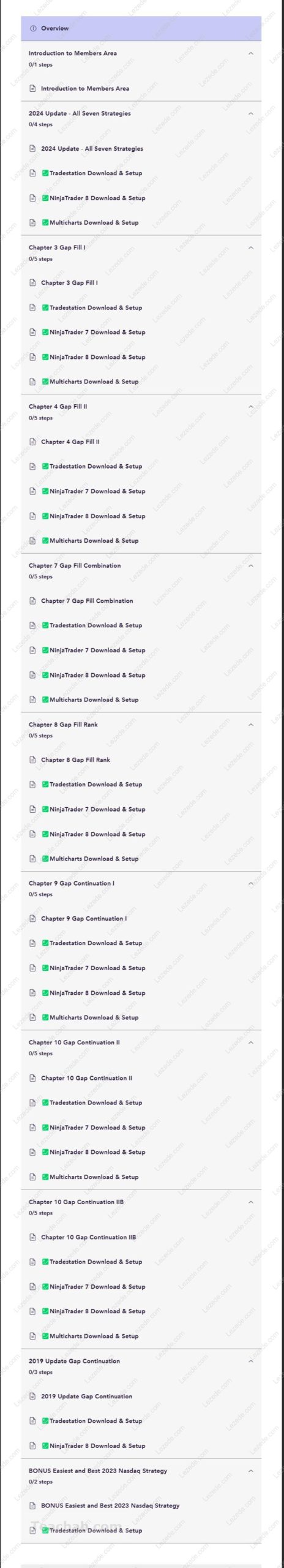

Overview of the Course Content

At its core, the course explores seven targeted trading strategies, each tailored to capitalize on specific gap behaviors in the market. Gap trading—a method centered around the price disparity between a market’s previous close and its next open—is the backbone of these systems. Here’s an overview of the strategies:

- Gap Fill I: This method aims to exploit the market’s natural inclination to “fill” price gaps. By identifying retracements, traders can capture profits as prices revert, with the psychology of market participants playing a key role.

- Gap Fill II: Expanding on the first, this system incorporates extra filters to improve the accuracy of predicting gap closures, helping traders make smarter, data-driven decisions.

- Gap Fill Combo: By merging aspects of Gap Fill I and II, this hybrid approach offers flexibility, making it useful across a range of market scenarios.

- Gap Fill Rank: This strategy assigns rankings to gaps based on the likelihood of being filled. It helps prioritize trades and manage risk more effectively by focusing only on high-probability setups.

- Gap Continuation: Unlike the fill methods, this system profits when gaps continue to move in the same direction post-open—a strategy that excels in strongly trending environments.

- Gap Continuation II: This advanced variation sharpens entry criteria, helping traders minimize false signals and better align with prevailing trends.

- Gap Continuation IIB: The most advanced system in the lineup, this approach leans on deeper market analysis to fine-tune timing and execution. It’s well-suited for traders ready to dive into more nuanced decision-making.

Updates and Adaptations

A major strength of this course is its adaptability. The content has been periodically revised to remain relevant as market conditions evolve. For instance, the 2019 update reflected the increasing volatility of the NASDAQ and refined the strategies accordingly.

The most recent 2024 update addresses ongoing behavioral shifts in market activity, ensuring that the systems remain sharp and effective. This commitment to timely updates empowers traders to stay ahead of new trends and market dynamics, reinforcing the course’s long-term value.

Educational Methodology

Capstone Trading favors a rule-based, mechanical style of instruction. This approach emphasizes clear, objective criteria that make strategies suitable for backtesting and automation—key factors in building effective trading systems. By focusing on logic and consistency, the course helps eliminate guesswork, which often leads to costly missteps.

Another benefit is its compatibility with popular trading platforms such as TradeStation, NinjaTrader, and MultiCharts. This cross-platform flexibility means learners can apply what they’ve learned in their preferred software environment. With clear implementation instructions, traders gain valuable experience working with actual data and market scenarios.

Practical Application and User Feedback

Traders who have taken the course generally report a highly favorable experience. A common theme among reviews is appreciation for the straightforward, actionable content. Many emphasize that the strategies are not just theoretical—they’re built for real-world trading.

The inclusion of open-source code is frequently cited as a highlight, allowing participants to tailor systems to their own style. Compared to many trading seminars, which can be heavy on theory but light on results, this course is often seen as a refreshingly practical alternative.

What users are saying:

- “The instructions were clear, and I could start using the strategies right away.”

- “Having the code made a big difference—I was able to customize everything to suit my approach.”

- “It gave me gap trading insights I hadn’t encountered before, even after years in the market.”

Conclusion

To sum up, Capstone Trading’s Seven Trading Systems Education Course delivers a practical, well-rounded education in gap trading and futures strategies. It combines structured, rule-based systems with real-time relevance and platform compatibility—making it ideal for traders at any stage of their journey. With thoughtful updates, transparent instruction, and emphasis on hands-on learning, this course offers exceptional value.

For anyone serious about mastering gap trading or building automated strategies grounded in proven principles, this program stands out as a top-tier resource. It provides the tools and knowledge traders need to succeed in an increasingly complex market.