Free Download the Simple Cyclical Analysis By Stan Erlich – Includes Verified Content:

Understanding Simple Cyclical Analysis by Stan Erlich: A Comprehensive Review

In the ever-evolving landscape of financial markets, the ability to recognize and act on patterns can spell the difference between consistent profitability and costly missteps. Stan Erlich’s Simple Cyclical Analysis provides a clear, actionable framework for traders seeking to decode the recurring rhythms of market behavior. By leveraging historical cycles, this method empowers traders to make smarter, more timely decisions. This review explores Erlich’s methodology, its key principles, the functionality of his proprietary tools, and its practical value across experience levels.

🔄 The Essence of Simple Cyclical Analysis

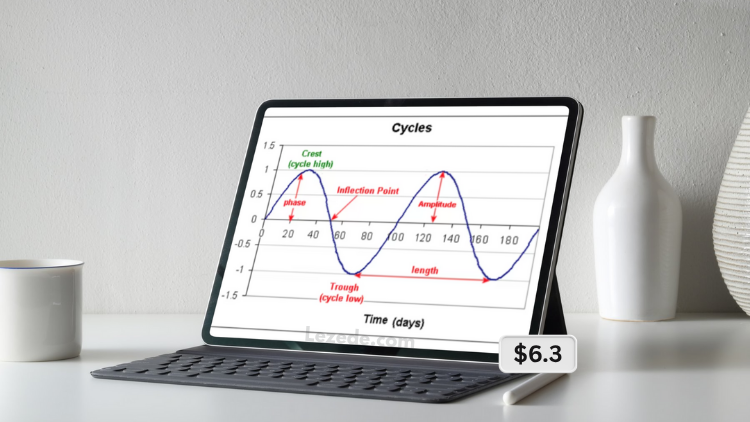

At its core, Erlich’s approach emphasizes the identification and interpretation of repeating cycles in market activity. Rather than reacting to minute-to-minute fluctuations, traders are encouraged to step back and observe the larger rhythms driving price action. Erlich asserts that cycles—ranging from short-term intraday to long-term macro—can be measured and used to forecast market movements more reliably.

This cyclical lens encourages traders to shift focus from noise to structure, integrating traditional tools such as the Relative Strength Index (RSI) and stochastics with a deeper understanding of time-based repetition. The result: a more comprehensive view of market dynamics that enhances both entry and exit timing.

📘 Key Concepts and Techniques

In his seminars and teachings, Erlich introduces several foundational concepts that underpin his strategy:

-

Identification of Dominant Cycles: Recognizing which time-based cycles currently exert the most influence on market behavior.

-

Cycle Responsiveness: Understanding the velocity and frequency of cycles to better anticipate turning points and volatility.

These techniques foster a proactive mindset, helping traders shift from reactive chart-watching to strategic engagement with market patterns.

🛠 Tools of the Trade: The Ehrlich Cycle Finder

Central to Erlich’s approach is the Ehrlich Cycle Finder, a proprietary tool designed to simplify the detection of active market cycles. By scanning historical data, the Cycle Finder identifies and visually represents repeating patterns that often precede significant price moves.

🔍 How It Works:

-

Analyzes price history to detect statistical regularities.

-

Highlights high-probability reversal zones.

-

Visualizes dominant cycles for actionable interpretation.

💡 Advantages:

| Feature | Benefit |

|---|---|

| Clarity | Translates complex data into accessible, visual insights. |

| Efficiency | Saves time by focusing attention on high-opportunity setups. |

| Confidence | Strengthens conviction by supporting timing with historical context. |

In an environment where timing is everything, the Cycle Finder provides both clarity and strategic edge.

⚙️ Practical Applications in Trading

Whether you’re managing a portfolio or actively trading intraday setups, Erlich’s cyclical framework introduces a layer of precision that enhances decision-making.

📈 Improving Market Timing

Understanding when a market is likely to peak or bottom allows traders to mitigate risk, optimize trade placement, and reduce emotional decision-making.

🔀 Compatibility with Other Strategies

A major strength of this approach is its versatility. Erlich encourages integrating cyclical analysis with:

-

Fundamental analysis

-

Trend-following systems

-

Momentum indicators

This synergy allows traders to build well-rounded, multi-factor strategies that account for both price and time.

🎯 Who Benefits from Erlich’s Method?

✅ For Beginners:

Erlich’s cyclical perspective simplifies the trading process by reducing the emphasis on dozens of confusing indicators. Instead, new traders gain a structured method to approach markets with focus and discipline.

✅ For Experienced Traders:

Seasoned professionals can use cyclical analysis to refine timing, discover new trade setups, and broaden their analytical toolkit. It can also serve as a valuable confirmation layer for existing strategies.

🧠 A System Rooted in Experience

Erlich’s methodology draws from over 50 years of market experience. His blend of empirical insight and practical application makes his system not only theoretically sound, but immediately useful for real-world trading.

“You don’t need to predict the future—you just need to recognize the cycle you’re in.” — Stan Erlich

✅ Conclusion

Stan Erlich’s Simple Cyclical Analysis presents a powerful, intuitive, and proven framework for understanding and profiting from recurring patterns in the market. Whether used as a standalone strategy or layered into a broader trading approach, this method enhances timing, reduces uncertainty, and improves confidence in trading decisions.

The Ehrlich Cycle Finder further empowers traders by visually identifying dominant cycles, transforming historical market data into strategic foresight.

For both beginners seeking structure and veterans looking for refinement, Erlich’s approach offers a timeless advantage in a time-driven marketplace.