Free Download the SpbankBook – Trendway Prime Two Day-Trading System – Includes Verified Content:

🧠 Detailed Review of the SPBankBook Trendway Prime Two Day-Trading System

In the competitive and fast-paced world of day trading, strategies that promise simplicity, accuracy, and high returns often draw considerable attention. One such strategy is the SPBankBook Trendway Prime Two Day-Trading System—a rules-based method designed to streamline trade execution using a singular technical study. Marketed toward traders seeking clarity in both long and short setups, this system positions itself as both beginner-friendly and robust enough for experienced traders.

In this comprehensive review, we’ll break down what the Trendway Prime system offers, how it works, its accuracy claims, risk management techniques, educational resources, and the skepticism surrounding it.

📊 System Overview: Simplicity Through Structure

The SPBankBook Trendway Prime system is centered around one key technical indicator: the 8-period moving average, referred to as the SAR (Stop and Reverse) line. This method is applied to the 5-minute chart, a popular timeframe for day traders who require balance between trade frequency and signal accuracy.

🔍 Key Features:

| Component | Details |

|---|---|

| Chart Type | 5-minute candlestick chart |

| Primary Indicator | 8-period moving average (SAR line) |

| Trading Direction | Supports both long and short trades |

| Signal Clarity | Based on price behavior around SAR line |

| Compatibility | Usable across most charting platforms |

The system’s appeal lies in its streamlined approach—avoiding multiple conflicting indicators—and focusing on one clean, interpretable signal.

🚀 Signal Generation: Clarity in Execution

What sets Trendway Prime apart from overly complex systems is its focus on actionable entry signals. Trades are triggered based on how price bars open and move in relation to the SAR line. For example, a break above the SAR may signal a long entry, while a drop below could indicate a short opportunity.

This system is praised for being intuitive enough for beginners, yet systematic and structured enough for professional traders who value repeatability and objectivity.

📈 Accuracy and Performance: The 93.75% Claim

One of the most striking elements of the SPBankBook Trendway Prime system is its reported 93.75% accuracy—a figure that understandably raises both interest and eyebrows in the trading community.

While some users claim to achieve these high success rates when strictly following the rules, such claims warrant critical evaluation. Trading is inherently variable, and results can depend heavily on:

-

Market volatility

-

Trader discipline

-

News events

-

Execution speed

Although this system may offer a statistical edge, real-world trading introduces variables that often diminish theoretical success rates.

⚖️ Risk Management: Fixed Fractional Position Sizing

Risk control is a cornerstone of sustainable trading, and this system adopts a fixed fractional position sizing model:

-

Initial position: 2 contracts per trade

-

Scalability: Positions increase as account equity grows

-

Risk alignment: Ensures risk exposure remains proportional

This method allows for controlled compounding, helping traders grow accounts without exposing them to outsized risk. It supports capital preservation, a key tenet in risk-aware day trading.

📘 Included Resources: Manual + Procedural Guide

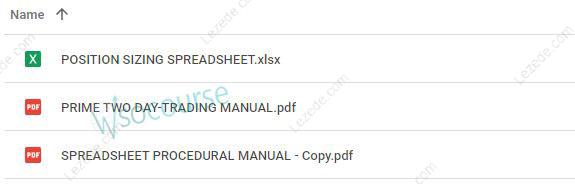

Upon purchase, users receive two key documents:

-

Trading Manual – Outlines the strategy rules with chart examples and trade logic.

-

Procedural Guide – A step-by-step playbook for daily implementation and signal interpretation.

These materials enhance the educational value of the product, bridging the gap between theory and live execution.

✅ Benefits of These Resources:

-

Clarity in signal interpretation

-

Visual reinforcement through sample charts

-

Confidence-building for newer traders

-

Step-by-step reinforcement for consistent use

⚠️ Skepticism & Due Diligence: A Word of Caution

As with any trading system claiming high accuracy and simplicity, healthy skepticism is warranted. Many traders online point out that no strategy is immune to:

-

Choppy, low-volume markets

-

Sudden reversals

-

Emotional trading interference

Forums and independent reviews caution prospective buyers to backtest the system thoroughly and ideally paper trade it before committing real capital.

🔎 Suggested Due Diligence:

-

Verify historical performance independently

-

Understand potential slippage in live trading

-

Monitor win/loss consistency over different market phases

-

Evaluate how much discretion is required despite rule-based claims

🎯 Who Is This System Best For?

The SPBankBook Trendway Prime system is likely best suited for:

-

Novice day traders seeking a simplified rules-based approach

-

Intermediate traders looking to tighten up entry/exit criteria

-

Busy professionals who want high-probability trades without monitoring multiple indicators

-

Risk-conscious traders who value capital preservation and position sizing

✅ Pros and Cons Summary

| Pros | Cons |

|---|---|

| Clear, rule-based system | Performance claims may be difficult to replicate |

| Works on a 5-minute chart—ideal for active traders | May underperform in low-volatility conditions |

| Simple indicator structure—minimal setup required | Not immune to market noise or emotional decision-making |

| Strong focus on risk management | Requires consistent discipline and execution |

| Includes helpful manuals and example charts | May not suit swing or long-term traders |

🧾 Final Verdict: A Tool, Not a Guarantee

The SPBankBook Trendway Prime Two Day-Trading System offers a structured, easy-to-follow approach to navigating fast-moving markets. With its focus on one clean technical indicator, accessible manuals, and scalable risk management, it provides a solid entry point for traders looking to refine or simplify their approach.

However, as with any system, it is not a magic bullet. The reported high accuracy should be approached with critical thinking and tested rigorously in simulated environments. Trading success depends as much on discipline, emotional control, and adaptability as it does on any technical system.

📌 Recommendation:

If you’re curious, technically inclined, and willing to test thoroughly, this system could offer a useful framework to build from. Just be sure to stay grounded in realistic expectations and ongoing education.