Stock Options Strategy: The CROC trade (low risk) by My Options Edge – Watch and Download Proof of Content for Free here:

Stock Options Strategy: The CROC trade (low risk) by My Options Edge – Download Video Sample for Free:

Stock Options Strategy: The CROC trade (low risk) by My Options Edge – Review Content Proof Here:

Stock Options Strategy: The CROC trade (low risk) by My Options Edge

The CROC Trade (low risk) by My Options Edge is a thoughtfully engineered options strategy designed to provide consistent monthly income by leveraging the decay behavior of the VXX volatility ETN—without being vulnerable to volatility explosions. It’s a low-maintenance, low-risk strategy ideal for traders seeking performance, protection, and peace of mind.

A Proven, Defensive Options Strategy for Volatility

The CROC Trade v2.0 is the result of months of research, refinement, and live trading experience. Developed after the success of prior VXX strategies, this version introduces clearer rules, improved profitability, and better trade management.

At its core, it is designed to benefit from VXX’s natural price decay (caused by contango and roll yield) while remaining self-hedged against volatility spikes—an essential trait in unpredictable markets. This makes the strategy highly suitable for conservative traders or those looking to generate monthly income in a low-stress way.

Built for Traders Seeking a Reliable Edge

This strategy is especially useful if you:

-

Struggle with inconsistent results using technical indicators

-

Have basic options knowledge but no clear trading plan

-

Lost confidence trading forex, stocks, or even stock options

-

Shorted volatility and suffered big drawdowns

-

Want a mechanical strategy with defined entry/exit rules

-

Prefer a strategy that doesn’t require daily monitoring

The CROC Trade addresses all of these issues by offering a structured, statistical, and time-tested options approach based on how volatility products like VXX behave in different environments.

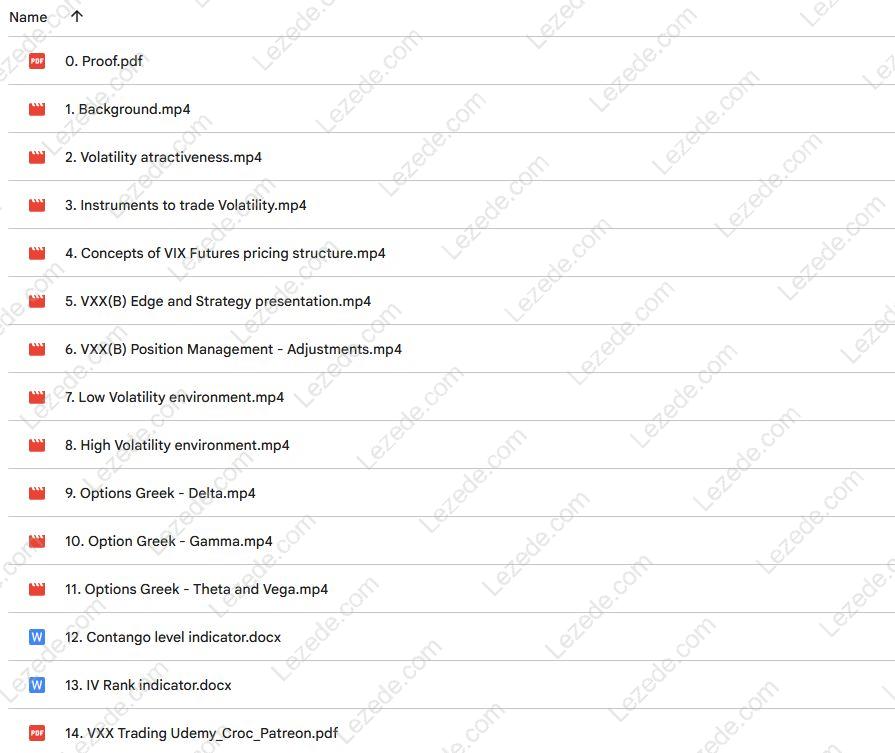

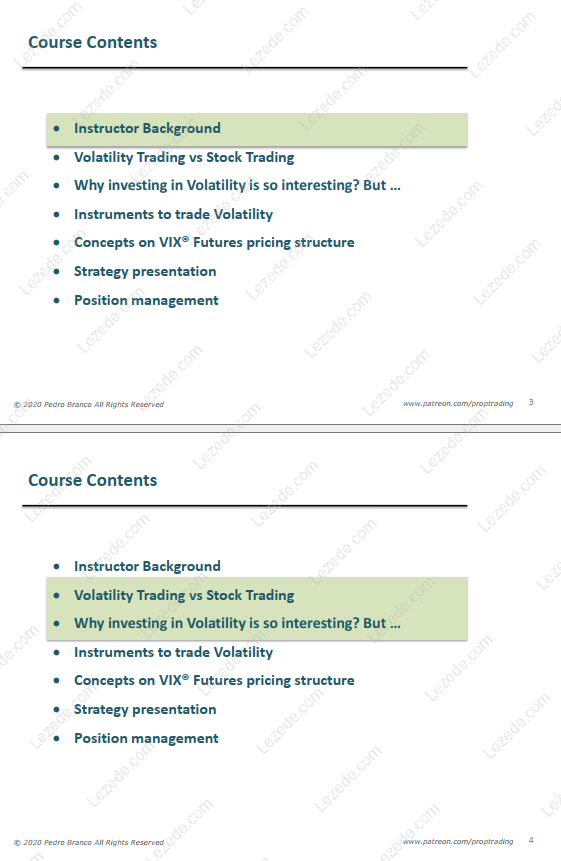

What You Will Learn in the Course

The course begins with foundational education on volatility behavior and market mechanics, then introduces the full strategy—including its structure, options trade rules, and how to adjust positions over time.

Here’s what’s covered:

-

The behavior of VIX®, VXX, and volatility products

-

Instruments and structures for volatility trading

-

Concepts of contango, backwardation, and roll yield

-

Strategy presentation and rationale

-

Trade dynamics and adjustment rules

-

How to manage risk and improve profitability

-

Detailed lessons on option Greeks (Delta, Theta, Vega, Gamma)

-

Backtesting results in both low- and high-volatility periods

-

Custom ThinkorSwim indicators (IV Rank, Contango level)

Everything is explained clearly, with downloadable materials and structured course lessons. Students will walk away with a fully executable plan.

Why This Strategy Is Unique

Unlike common strategies taught in books, the CROC Trade v2.0 has several built-in advantages:

-

Limited upside risk – Self-hedged against sudden volatility spikes

-

Controlled downside – Well-defined risk to the lower end

-

Profits from time decay – Positive Theta setup

-

Low Delta exposure – Reduced sensitivity to price movement

-

Monthly income potential – Built for consistency

-

IRA-compatible – Can be used in retirement accounts

All of these features make it one of the most robust and low-maintenance strategies available for volatility-based trading today.

Who Should Take This Course?

This strategy is ideal for:

-

Intermediate options traders with basic understanding of Greeks

-

Volatility traders seeking monthly income

-

Anyone looking for a safer, smarter alternative to shorting volatility

-

Traders tired of lagging indicators and inconsistent systems

-

IRA investors who want growth with risk control

No need to monitor trades daily, and you don’t need advanced programming or modeling skills to execute it. It’s plug-and-play, once you understand the setup.

Conclusion: Trade Smarter With The CROC Trade

The Stock Options Strategy: The CROC trade (low risk) by My Options Edge isn’t just another theory-heavy course—it’s a complete investment approach. With defined rules, tested performance, and a structure that favors both safety and consistency, it’s an ideal solution for traders who want to grow their capital the smart way.

Whether you’re transitioning from traditional strategies or simply looking for an efficient way to generate income, the CROC Trade is worth mastering.