Stock & Options Strategy: Volatility Surf Trade (low risk) by My Options Edge – Watch and Download Proof of Content for Free here:

Stock & Options Strategy: Volatility Surf Trade (low risk) by My Options Edge – Download Video Sample for Free:

Stock & Options Strategy: Volatility Surf Trade (low risk) by My Options Edge – Check Course Content below:

Stock & Options Strategy: Volatility Surf Trade (low risk) by My Options Edge

The Volatility Surf Trade (low risk) by My Options Edge is a practical and highly profitable strategy that combines stock and options to take advantage of the long-term price erosion of volatility ETNs like VXX and UVXY. Designed for ease of use and consistent performance, this method empowers traders to profit from predictable market dynamics—without relying on technical indicators or guesswork.

A Simple Yet Powerful Strategy for Volatility Trading

Volatility ETNs such as VXX and UVXY are structured to lose value over time due to contango and roll yield. This strategy is built to capitalize on that price behavior, offering steady capital appreciation with limited risk.

It uses a blend of stock positions and options trades, creating a hybrid structure that benefits from time decay and volatility inefficiencies. The course is ideal for traders who have basic options knowledge but are seeking a consistent strategy that’s both proven and easy to apply.

Why You Should Take This Course

This course was created for traders who:

-

Are frustrated with purely theoretical trading courses

-

Struggle with inconsistent results using technical analysis

-

Lost capital shorting volatility or scalping stocks

-

Are tired of non-profitable indicator-based systems

-

Want a mechanical trading system with clear rules

-

Prefer a low-maintenance strategy that doesn’t require constant monitoring

By combining stock exposure and options-based protection, the Volatility Surf Trade offers a smart and sustainable way to trade volatility—even in turbulent markets.

What the Course Covers

The course begins with an overview of volatility market fundamentals, such as:

-

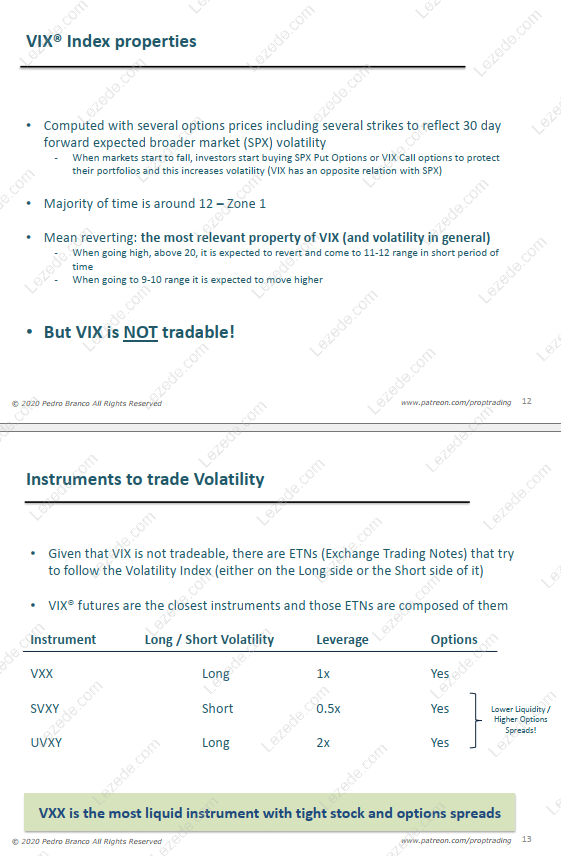

VIX® futures structure and its influence on volatility ETNs

-

Contango, backwardation, and roll yield

-

Volatility trading instruments and market behavior

From there, it dives deep into:

-

Strategy rationale and construction

-

Entry and exit rules for the Basic Surf Trade

-

Modified version of the Surf strategy (for higher volatility environments)

-

Option Greeks (Delta, Gamma, Vega, Theta) explained in practical context

-

Trade management guidelines and live trade examples

-

Backtests demonstrating the strategy’s robustness and reliability

A Defensive Strategy With Strong Upside

What sets this strategy apart is its structure:

-

It profits from VXX/UVXY price decay

-

Uses options for downside control and upside hedging

-

Delivers low Delta exposure, reducing price sensitivity

-

Works even if you have no experience with technical indicators

-

Does not require daily monitoring

-

Can be used in IRA accounts

-

Backtested for both low and high volatility markets

This makes it suitable for traders who want to grow their portfolios while minimizing risk exposure—and without the stress of day trading.

Tools, Indicators & Bonus Material

As part of the course, students get access to:

-

Custom ThinkorSwim indicators (Contango Level, IV Rank)

-

Downloadable materials and strategy rules

-

Real trade examples for practice and clarity

-

Guidelines on how to adapt the strategy to different volatility environments

This training isn’t just theory—it’s built from live market experience and structured for repeatable success.

Final Thoughts: Ride the Volatility Wave with Confidence

The Stock & Options Strategy: Volatility Surf Trade (low risk) by My Options Edge is more than just a trading idea—it’s a complete, executable plan that can enhance the performance of your stock or ETF portfolio. Whether you’re transitioning from struggling with stock strategies or looking to specialize in volatility, this method gives you the tools, structure, and confidence to trade smarter.

No indicators, no guessing—just clear signals, tested setups, and consistent results.