Stock Options Strategy: VXX Short Vertical (mid/high risk) by My Options Edge – Watch and Download Proof of Content for Free here:

Stock Options Strategy: VXX Short Vertical (mid/high risk) by My Options Edge – Download Video Sample for Free:

Stock Options Strategy: VXX Short Vertical (mid/high risk) by My Options Edge – Review Content Proof Here:

Stock Options Strategy: VXX Short Vertical (mid/high risk) by My Options Edge

If you’re seeking a simple yet powerful income-generating strategy, the VXX Short Vertical options strategy by My Options Edge is a compelling approach to consider. Built on a strong statistical edge and used in real weekly trades, this strategy is tailored for traders looking to profit from volatility with consistency—especially under specific, defined market conditions.

A Weekly Income Options Strategy That Works

This strategy centers around VXX, a volatility-based ETN that offers more predictable price movements than many stocks or currency pairs. With this system, you can generate steady weekly income using short vertical call spreads, particularly during times when the market structure favors a volatility play.

Designed for mid to high risk tolerance, the method avoids complex adjustments and is easy to apply—even for traders with only basic options knowledge. Once the trade setup aligns with defined market indicators, you execute, manage the position, and let the strategy deliver.

Based on Real-World Trading Experience

The course is taught by an experienced options trader who has moved away from stock and forex trading to focus solely on volatility strategies. VXX is one of the core instruments in his portfolio, thanks to its unique behavior, structure, and opportunities for income generation.

This system also complements his CROC Trade, making it a perfect addition for anyone already practicing advanced volatility plays.

What You’ll Learn in the Course

The training goes beyond surface-level explanations. It starts with a foundation in volatility mechanics, then guides you step-by-step into building and executing the strategy.

Topics include:

-

The structure of the VIX® index and how it relates to VXX

-

Understanding contango, backwardation, and roll yield

-

Risk management techniques tailored for volatility

-

Entry-level and advanced versions of the Short Vertical strategy

-

A hedging component using VIX options

-

Optimization techniques to improve long-term performance

-

Detailed backtests and real trade results (including live updates)

Plain Vanilla vs. Discretionary Rules

You’ll learn both mechanical rules for easy implementation and discretionary enhancements for extra profitability. This makes the course ideal for both beginners who want a plug-and-play system and experienced traders seeking to fine-tune their edge.

Plus, the course includes backtested performance from volatile periods like 2018, showing how the system holds up under stress.

Built-in Risk Control and IRA-Friendly

This strategy is built with controlled risk in mind and can even be used within IRA accounts, making it accessible to a wider range of investors. The course includes explanations of all trading rules, optimization tests, and hedging methods that help reduce exposure while preserving returns.

You don’t need advanced options knowledge or experience—just a brokerage account and the commitment to follow a proven plan.

Real Results, Real Trades, Real Tools

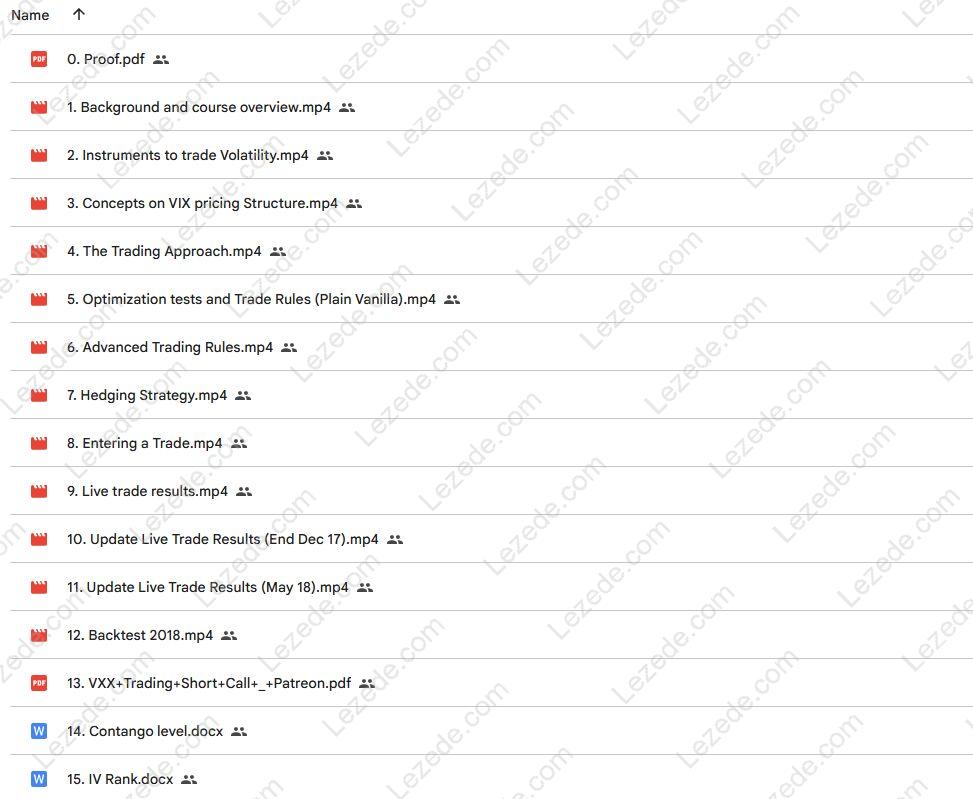

The training includes:

-

Real live trade updates (with data from Dec 17 and May 18)

-

A downloadable PDF with VXX short call indicators

-

A BONUS section covering ThinkorSwim custom indicators

-

Historical backtests proving strategy consistency across different market environments

Every module is designed to help you understand not just what to do, but why it works—ensuring you develop skill, not just memorization.

Why Choose the VXX Short Vertical Strategy?

Volatility trading is often misunderstood, but when done right, it can be incredibly profitable. This course gives you a complete roadmap, from fundamentals to implementation. And with VXX’s unique behavior and the short vertical spread’s natural time decay advantage, you’re positioned to grow your portfolio—even in choppy markets.

Whether you’re new to options or a seasoned trader looking to expand into volatility, the Stock Options Strategy: VXX Short Vertical (mid/high risk) by My Options Edge is a strong addition to your trading toolbox.