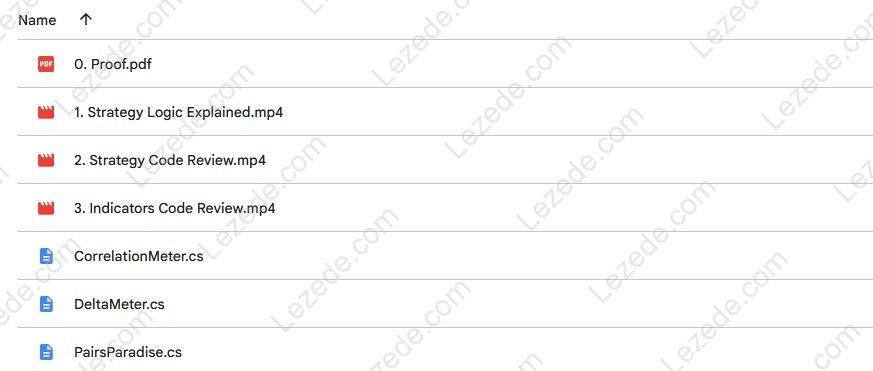

Synthetic Arbitrage – Pairs Trading by Ninja Coding, Free download Proof of content:

Synthetic Arbitrage – Pairs Trading by Ninja Coding – Watch Content Proof here:

Synthetic Arbitrage: A Comprehensive Review of Pairs Trading by Ninja Coding

As financial markets continue to evolve, traders are adopting increasingly innovative strategies that combine traditional principles with modern tools. One such approach gaining momentum is synthetic arbitrage, particularly within the field of pairs trading. This method revolves around taking advantage of temporary price divergences between two highly correlated assets. Leveraging platforms like NinjaTrader, traders are now able to craft complex trading systems using advanced programming, positioning themselves ahead of the curve.

Understanding Synthetic Arbitrage and Its Mechanism

At its core, synthetic arbitrage involves forming a synthetic relationship between two or more correlated securities. The aim is to benefit from short-term deviations in their price relationships. Traders typically monitor asset pairs that historically move together and then take long and short positions simultaneously when temporary divergences occur—anticipating a reversion to their mean.

To identify such opportunities, traders often analyze correlation coefficients, which quantify the strength and direction of price movement between instruments. A coefficient close to +1 shows strong positive correlation, while values near -1 suggest inverse movement. When one asset significantly deviates from its paired counterpart, it flags a possible arbitrage trade. This quantitative insight forms the foundation of many effective strategies in the space.

Implementation of Synthetic Arbitrage in NinjaTrader

NinjaTrader is widely recognized for its robust technical infrastructure, which makes it ideal for deploying synthetic arbitrage strategies. Traders can utilize NinjaScript—its proprietary scripting language—to develop automated strategies that respond to specific market signals, such as shifts in correlation or price spreads.

By setting up trading algorithms or alerts, users can execute trades automatically when conditions are met. This high-speed execution is crucial for exploiting short-lived inefficiencies in the market. Additionally, NinjaTrader’s powerful backtesting engine enables users to test strategies on historical data, helping them fine-tune parameters for better results.

Charting and Analysis: Tools for Successful Trading

Accurate market analysis plays a central role in executing synthetic arbitrage successfully. NinjaTrader’s advanced charting functions support this by offering detailed visualization tools and indicators designed to track correlation between instruments.

Through these tools, traders can visually detect when one security diverges from its typical movement relative to another, helping them time entries and exits with greater precision. Multi-symbol support further enhances this process by allowing traders to evaluate and trade multiple correlated assets simultaneously, increasing the number of potential arbitrage opportunities.

Strategies and Techniques for Successful Pairs Trading

Several tactics and methodologies underpin successful synthetic arbitrage strategies. Below are some of the most essential components:

-

Correlation Analysis: Monitoring how closely two instruments move together is crucial. Traders often rely on dynamic correlation indicators across various timeframes to identify ideal trade setups.

-

Multi-Instrument Trading: Utilizing NinjaTrader’s capabilities, traders can construct systems that track and respond to multiple securities. This broadens the scope of potential trades and uncovers more frequent arbitrage signals.

-

Risk Mitigation: Swift execution alone isn’t enough—managing risk is critical. Traders must consider latency, slippage, and cost implications. Tools like stop-loss orders help reduce exposure to sudden market shifts.

Blending these elements into a cohesive strategy gives traders a strong foundation to execute synthetic arbitrage more reliably and profitably.

The Role of Educational Resources in Mastering Strategies

Education remains a cornerstone of trading success. Ninja Coding provides comprehensive educational bundles designed to guide traders through the nuances of synthetic arbitrage within the NinjaTrader environment. These include tutorials on building custom indicators, managing trade logic, and fine-tuning tick-level strategies.

With markets constantly evolving, staying current with new methodologies is vital. Gaining both theoretical and practical knowledge helps traders elevate their decision-making and implementation skills—turning strategy into success.

Conclusion: The Potential of Synthetic Arbitrage through Pairs Trading on NinjaTrader

To conclude, synthetic arbitrage via pairs trading presents a well-defined method for capitalizing on temporary price mismatches between correlated assets. With NinjaTrader’s advanced scripting, analytical tools, and comprehensive educational materials, traders are well-equipped to deploy and enhance these strategies. In an increasingly data-driven trading world, mastering such techniques offers traders a lasting edge and an opportunity to thrive in complex market conditions.