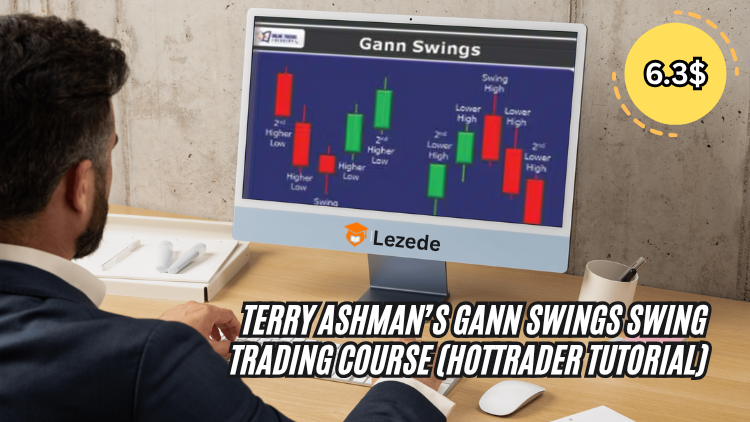

Free Download Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

Check content proof, now:

Simplicity in Its Purest Form…

Markets may appear different on the surface—whether it’s soybeans, stocks, forex, or futures—but they all move in surprisingly similar ways. The underlying reason is simple: every market is influenced by human emotion—fear, greed, and panic remain constant drivers across all asset classes.

What Defines a Successful Trader?

Why do some individuals build immense wealth through trading, while others repeatedly stumble and fail?

From my perspective, the true “holy grail” of trading is proper education.

It’s impossible to consistently outperform experienced traders without a solid grounding in proven techniques—this includes reliable strategies, effective money management, emotional control, and the virtue of patience.

Trusting Yourself Over Others

I’ve stopped relying on anyone else’s opinion about market direction. Over time, I realized most traders—perhaps all—lack any real edge in forecasting future price movements beyond my own. Moreover, their insights are almost always clouded by bias, shaped by their holdings and preferred time frames.

For instance, if someone owns a significant amount of a stock, they’ll naturally claim it’s going to rise—that’s the reason they own it, after all. Their views are typically optimistic because that’s what benefits their position.

My Analytical Approach

Today, my market decisions are based on tested indicators, many of which are inspired by the timeless work of W.D. Gann and Fibonacci.

I’ve encountered countless interpretations of their methods, but, as the title suggests, simplicity always stands out. With proper knowledge and persistence, anyone can succeed in trading. It’s not overly complex. All you really need are reliable trade signals and the discipline to act only when they appear—then allocate a portion of your capital accordingly.

Trading With the Trend

It’s crucial to emphasize that trading in the direction of the trend is the cornerstone of my entire strategy. I avoid trading against the trend or chasing counter moves. Instead, I wait patiently until the chart gives a clear signal, then move in that direction.

I’m not interested in being the first to predict or outsmart the market—I’d rather follow its movement and profit in the process.

Discovering Trends with the Gann Swing Chart

The simplest and most effective method I’ve found for identifying trends is through the Gann swing chart.

This charting method reflects price action by tracking bar-to-bar direction, and the resulting swings form recognizable patterns that can serve as powerful indicators for profitable trades.