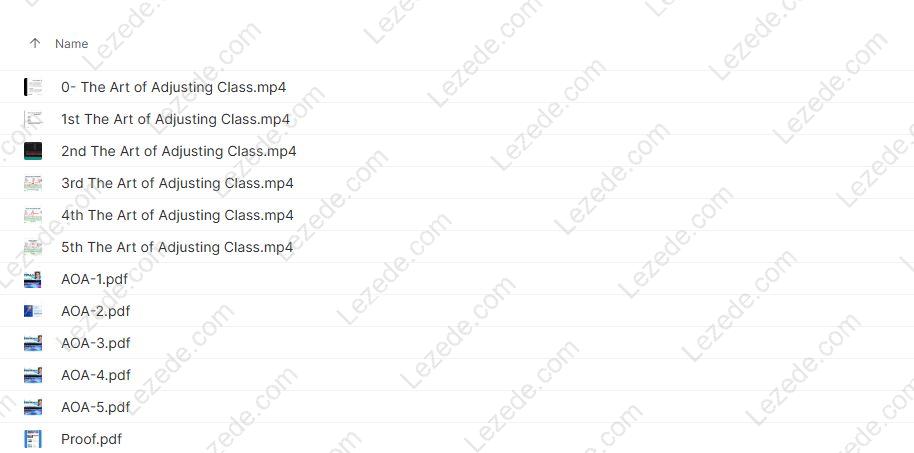

Free Download THE ART OF ADJUSTING IN 2017 BY SHERIDANMENTORING – Includes Verified Content:

THE ART OF ADJUSTING IN 2017 BY SHERIDANMENTORING

The Art of Adjusting in 2017 by SheridanMentoring is a comprehensive on-demand class series designed for options traders who want to master the techniques of adjusting trades to manage risk, protect capital, and optimize profits. Led by Dan Sheridan and Jay Bailey, this course provides detailed insights into real-world trading adjustments using credit spreads, butterflies, iron condors, calendars, and more.

With a combination of video lessons, PDF slides, and trade updates, this class empowers traders to make informed, strategic adjustments in volatile markets.

Course Overview

The course is structured into five in-depth sessions, each recorded and archived for unlimited review. Each session lasts approximately one hour and includes practical examples, step-by-step instructions, and tactical guidance for applying adjustments in live markets.

What You’ll Learn in Each Class

Class #1: Laying the Foundation for Adjustments with Dan Sheridan

-

Understanding what an adjustment is and its purpose.

-

How adjustments fit into a 4-step risk management plan.

-

Most common types of adjustments and Dan’s Matrix Decision Making Process.

-

How much and how often to adjust positions.

-

Using VIX as a guide for adjustments.

-

Adjusting credit spreads and managing trades when SPX moves 1% in a day.

Class #2: Why? When? How? with Jay Bailey

-

Fundamental reasons to adjust trades.

-

Pros and cons of adjustments.

-

Real examples including butterflies, calendars, and iron butterflies.

-

Objectives for Delta, Vega, and Theta when adjusting.

-

Factors to consider and pitfalls to avoid.

-

Upside and downside strategies for effective trade adjustments.

Class #3: Adjusting Balanced Butterflies with Dan Sheridan

-

Step-by-step guidance for adjusting balanced butterfly trades.

-

Strategies to maintain risk-reward balance while optimizing profits.

Class #4: Adjusting Broken Wing Butterflies and Iron Condors with Dan Sheridan

-

How to adjust broken wing butterflies for favorable outcomes.

-

Adjustment strategies for iron condors to limit risk and protect capital.

Class #5: Adjusting Calendars and Miscellaneous Issues

-

How to adjust single and double calendars.

-

Macro and micro perspective of adjustments.

-

Portfolio-level adjustments using beta weighting.

-

Strategies to handle max loss scenarios and guard against Black Swan events.

-

Warnings for covered writes, put credit spreads, and other popular strategies.

Course Format

-

On-Demand Access: Login credentials are provided after purchase.

-

Multi-Media Learning: Access to all class recordings, PDFs, PowerPoints, and trade updates.

-

Expert Guidance: Learn directly from experienced traders Dan Sheridan and Jay Bailey.

-

Practical Application: Each lesson includes real-life examples for immediate implementation.

Why This Course Matters

-

Learn the art of adjusting trades for consistent profits and risk management.

-

Understand the mechanics of options adjustments across various strategies.

-

Gain confidence to act decisively during volatile markets.

-

Suitable for traders at all experience levels, from beginners to seasoned professionals.

-

Avoid common pitfalls and maximize the potential of each trade.

By mastering trade adjustments, you can protect your portfolio, limit losses, and enhance returns while trading options with confidence.