Free Download the The Correlation Code by Jason Fielder – Includes Verified Content:

The Correlation Code by Jason Fielder: A Comprehensive Review for Forex Traders

Mastering Forex Through Currency Correlation

In today’s fast-moving forex markets, understanding how currency pairs interact can unlock powerful trading advantages. The Correlation Code by Jason Fielder is a groundbreaking system that dives deep into the often-overlooked world of currency correlation, providing traders with a reliable framework to improve accuracy, reduce risk, and maximize profitability.

Whether you’re new to trading or looking to enhance your current strategy, this in-depth review outlines how the Correlation Code transforms theory into results-driven action using real-world strategies, proprietary software, and a unique edge in spotting profitable trading anomalies.

What Is Currency Correlation in Forex?

Currency correlation measures how two forex pairs move in relation to one another:

-

Positive Correlation (+1): Both pairs move in the same direction.

-

Negative Correlation (–1): Pairs move in opposite directions.

-

Zero Correlation (0): No consistent relationship exists.

Understanding these dynamics allows traders to anticipate price behavior, avoid overexposure, and develop smarter portfolio strategies. For example, if EUR/USD and GBP/USD are strongly correlated, a move in one often signals movement in the other—critical insight for informed decision-making.

Jason Fielder’s system teaches traders how to analyze these patterns and apply them tactically, not just reactively, giving them the confidence to trade with greater precision.

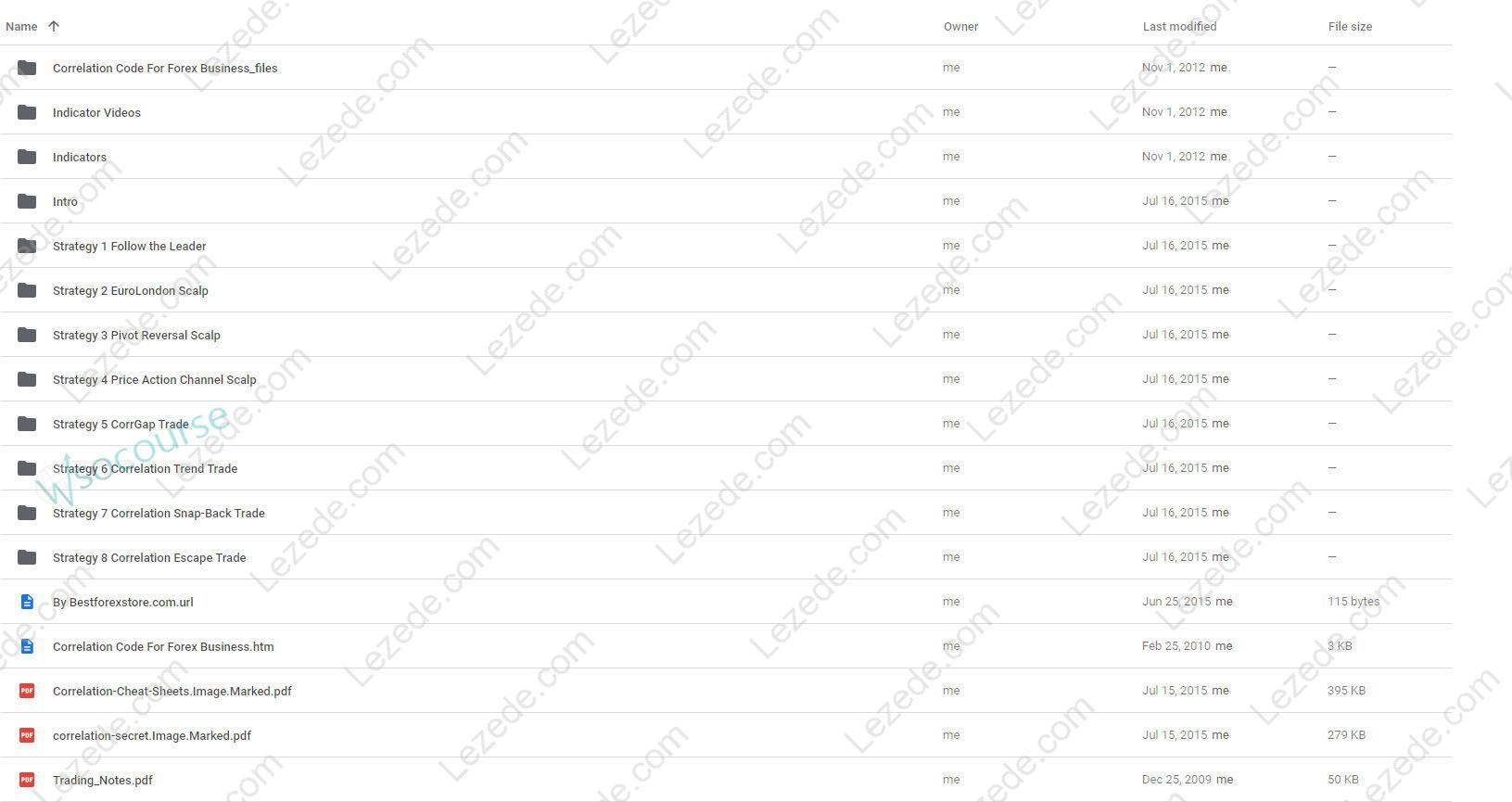

Seven Proven Forex Correlation Strategies

At the heart of the Correlation Code are seven professionally developed trading strategies, each built around years of market research. These methods help traders harness correlation patterns for high-probability setups:

-

Pair Diversification – Spread risk by selecting pairs with different correlation behaviors.

-

Convergence Trading – Profit when diverged pairs return to normal correlation.

-

Divergence Exploitation – Identify temporary cracks in correlation and trade the anomaly.

-

Synthetic Currency Pairs – Use software to create new pair combinations with unique opportunities.

-

Trend Confirmation – Confirm trends across correlated pairs before entering.

-

Risk Management – Apply correlation data to limit drawdowns and balance exposure.

-

Market Sentiment Analysis – Gauge the broader market mood by tracking how major pairs move together.

These structured strategies offer practical, repeatable ways to increase trading edge and capitalize on inefficiencies most traders miss.

Powerful Tools: The Proprietary Correlation Code Software

Fielder’s course is more than a set of strategies—it includes a cutting-edge software platform that brings correlation trading to life. The software delivers:

-

Real-time correlation analysis for dozens of major and cross pairs

-

Automated detection of anomalies and synthetic pair creation

-

User-friendly dashboards for traders of all levels

-

Instant identification of actionable trading setups

With this platform, traders can simplify complex calculations and make decisions faster with higher confidence—eliminating guesswork and improving consistency.

Grounded in Fundamental Market Principles

The Correlation Code stands apart by rooting its analysis in economic fundamentals, not just chart patterns. It emphasizes understanding the forces that truly drive correlations:

-

Central bank policy

-

GDP and employment data

-

Inflation and interest rate trends

-

Geopolitical shifts and sentiment shocks

By aligning correlation insights with economic events, traders can gain a deeper, more accurate perspective on market behavior, improving the longevity and adaptability of their trading approach.

Spotting Market Anomalies: The “Crack” Opportunity

Fielder introduces a powerful concept: market cracks, or moments when currency pairs temporarily break from their normal correlation behavior. These outliers often signal:

-

Imminent reversals or breakouts

-

Sentiment misalignments

-

Event-driven volatility windows

The Correlation Code software detects these cracks and helps traders execute timely entries and exits based on historical behavior and current momentum. Real-world case studies demonstrate how traders have used this system to capitalize on unique, high-reward trades.

Excellent User Experience and Community Support

Jason Fielder backs his program with a 100% satisfaction guarantee and ongoing community engagement. Highlights include:

-

Clear, structured modules with progressive learning paths

-

Responsive customer support

-

A vibrant trading community to share strategies and insights

-

Real success stories from traders who have achieved consistent profits

Whether you’re self-paced or hands-on, the Correlation Code supports you every step of the way.

Educational Value Beyond the Average Trading Course

Unlike many forex courses that focus solely on signals or setups, the Correlation Code emphasizes true trader development. Its educational benefits include:

-

Strategic thinking frameworks for long-term success

-

Actionable learning modules for immediate implementation

-

Skill-building exercises to improve analysis and decision-making

-

Ongoing updates and support as market conditions evolve

This investment in trader education ensures you don’t just follow a system—you understand it deeply and grow with it.

Key Features Overview

| Feature | Description |

|---|---|

| Understanding Correlation | Explains inter-pair dynamics and market impact |

| Seven Core Strategies | Includes pair diversification, trend confirmation, and anomaly trading |

| Proprietary Software | Real-time analysis, synthetic pairs, and automated detection |

| Fundamental Focus | Connects correlation with macroeconomic data and sentiment |

| Unique Market Cracks | Identifies and exploits temporary divergence opportunities |

| User Support & Community | Satisfaction guarantee, peer group interaction, and responsive assistance |

| Deep Educational Value | Strategic mindset training, interactive learning, and skill development |

Final Thoughts: Is the Correlation Code Worth It?

Yes—especially if you want a smarter, more strategic way to trade forex. Jason Fielder’s Correlation Code system is a rare combination of technical strategy, economic insight, and real-world application. It empowers traders to break free from guesswork and base decisions on measurable relationships between currency pairs.

Whether you’re just starting out or scaling your trading portfolio, this system delivers the tools, training, and technology to succeed with confidence.