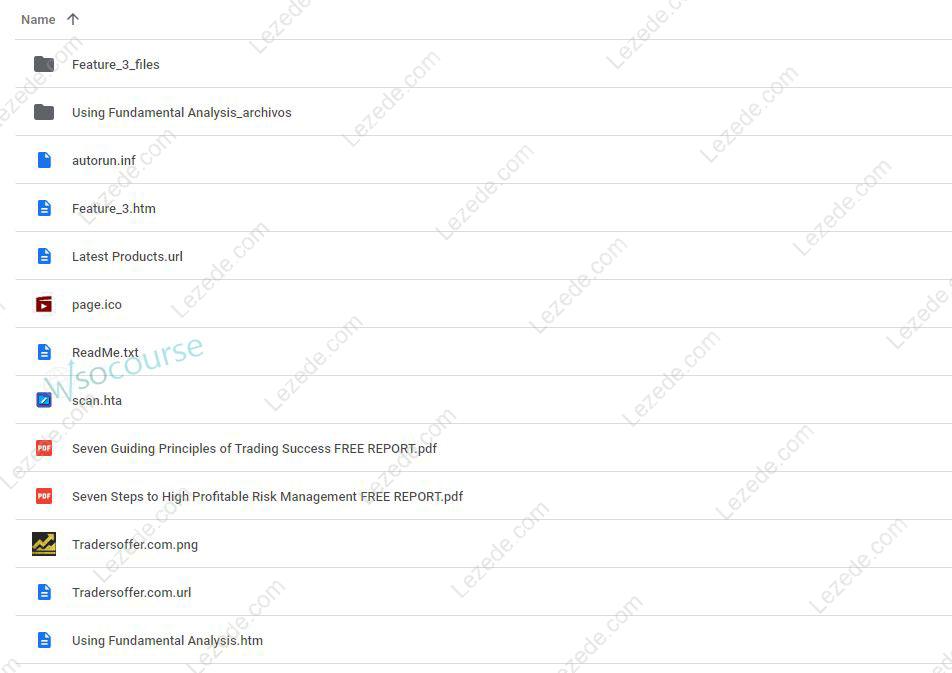

Free Download the Using Fundamental Analysis by Andrew Baxter – Includes Verified Content:

Mastering Fundamental Analysis with Andrew Baxter: A Complete Course Review

In today’s complex investment landscape, understanding the true value of assets is critical to long-term success. Andrew Baxter’s course on Fundamental Analysis offers a comprehensive and accessible framework for analyzing companies, industries, and economies—empowering traders and investors to make data-driven decisions that go beyond short-term market noise.

📘 What is Fundamental Analysis?

Fundamental analysis is the process of evaluating a security’s intrinsic value by examining economic conditions, industry trends, and financial statements. It provides a grounded perspective on whether a stock is overvalued or undervalued.

Baxter’s course introduces this methodology as the backbone of intelligent investing, helping participants avoid emotionally driven or speculative trading decisions.

🧱 Core Components of Baxter’s Fundamental Analysis Curriculum

Andrew Baxter divides the subject into three tiers of analysis:

1. Economic Analysis (Macro-Level)

Understanding GDP growth, inflation, interest rates, and employment gives investors a view of the economic cycle.

➡ Example: Rising interest rates can slow down borrowing and consumer spending, impacting corporate earnings.

2. Industry Analysis

Each sector has unique characteristics. The course trains students to evaluate:

-

Market competition

-

Regulatory landscape

-

Growth potential and innovation cycles

➡ Example: Renewable energy vs. traditional energy sectors under different regulatory pressures.

3. Company Analysis

The heart of the course—teaching how to dissect:

-

Income Statements → Are they profitable?

-

Balance Sheets → Are they financially sound?

-

Cash Flow Statements → Is the business sustainable?

| Statement | Purpose | Key Metrics |

|---|---|---|

| Income Statement | Profitability over time | Revenue, Net Income, EBITDA |

| Balance Sheet | Financial position | Assets, Liabilities, Equity |

| Cash Flow Statement | Operational strength | Operating Cash Flow, Free Cash Flow |

🎓 What You’ll Learn

Baxter’s course is not just theoretical—it’s packed with practical knowledge you can apply immediately:

✅ Financial Statement Mastery

Learn how to spot red flags or hidden value in company reports.

✅ Strategic Decision-Making

Make confident investment choices based on long-term business fundamentals, not short-term market hype.

✅ Combining with Technical Analysis

Baxter encourages a hybrid approach, using fundamentals to assess quality and technicals to fine-tune timing.

⚠️ Course Limitations (and Why They Matter)

Baxter doesn’t pretend that fundamental analysis is perfect. He transparently covers challenges such as:

-

Market Sentiment Influence: Stock prices often reflect emotions, not logic.

-

Data Limitations: Financials can be misleading or outdated.

-

Geopolitical Shocks: External events can distort fundamentally sound positions.

➡ Bottom Line: Use fundamentals as your core compass, but never ignore broader market context.

💼 Real-World Case Studies

The course includes live examples and historical case studies to bridge theory and real-world application.

Example:

A company with declining earnings, but rising free cash flow and low debt—revealing a turnaround opportunity missed by technical traders.

These insights help students:

-

Identify buy opportunities before the crowd

-

Avoid value traps disguised as cheap stocks

-

Gain confidence in building a resilient long-term portfolio

🏆 Who Should Take This Course?

✅ Beginner Investors: Learn the foundations of value-based investing

✅ Intermediate Traders: Improve accuracy in identifying quality companies

✅ Long-Term Portfolio Builders: Shift from emotional to evidence-based decisions

✅ Fundamental Analysts: Sharpen your analytical process with a structured system