Free Download Using Median Lines as a Trading Tool by Greg Fisher – Includes Verified Content:

Using Median Lines as a Trading Tool by Greg Fisher: A Comprehensive Review

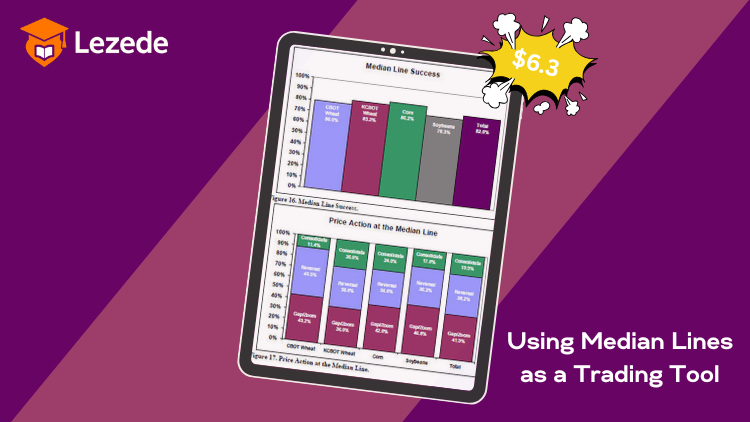

Using Median Lines as a Trading Tool by Greg Fisher delivers a structured analysis of one of the most precise and underutilized technical strategies in trading—Dr. Alan H. Andrews’ median line method. Fisher’s empirical study, which focuses on agricultural markets from 1990 to 2005, validates this method’s accuracy and offers valuable insights for traders looking to enhance their forecasting tools.

Understanding the Median Line Method

At the core of Andrews’ pitchfork lies the median line, representing the equilibrium price level markets often revert to. According to Fisher, when drawn from three significant price pivots, this tool can forecast both price direction and timing with up to 80% accuracy.

Unlike conventional indicators, the median line approach requires traders to adopt a disciplined and methodical strategy. Its effectiveness depends heavily on how accurately the lines are constructed, making it a tool for those committed to deep technical analysis.

Fisher’s Structured Validation Process

What sets Greg Fisher’s study apart is its scientific, data-backed approach. By evaluating 15 years of agrarian market data, he confirms that the median line method consistently forecasts price reversion with remarkable accuracy.

Fisher’s validation method includes:

-

Identifying three key price pivots

-

Drawing the median line and upper/lower parallels

-

Measuring how often prices return to this median

The result is a systematic confirmation of Andrews’ theories, giving traders statistical backing for incorporating this tool into their strategy.

Practical Limitations and Market Adaptation

Fisher is transparent about the method’s limitations. While highly effective in agricultural markets, results may vary in other sectors. Market conditions, trader skill level, and subjective interpretation can all affect outcomes.

He emphasizes that consistent application and a solid grasp of market behavior are crucial. Without disciplined execution, even this highly accurate tool can yield inconsistent results.

Key Takeaways from Fisher’s Research

Fisher’s empirical analysis highlights several major findings:

-

Historical Accuracy: Confirms Andrews’ 80% accuracy claims within the agrarian market (1990–2005)

-

Methodical Rigor: Demonstrates the importance of a structured, repeatable process

-

Market-Specific Use: Recognizes the need for adapting the tool to different markets

-

Discipline & Consistency: Stresses that accuracy depends on how rigorously the method is applied

Modern Trading Implications

Fisher’s research offers actionable insights for traders today:

-

Improved Forecasting: Enhances timing and accuracy of market entries and exits

-

Risk Management Tool: Offers clear zones to set stop-loss and take-profit points

-

Strategic Planning: Helps traders define logical trade setups based on price reversion

-

Flexible Integration: Can complement other tools like moving averages or Fibonacci retracements

Comparison with Other Technical Indicators

| Feature | Median Line Method | Moving Averages | Bollinger Bands |

|---|---|---|---|

| Predictive Accuracy | ~80% (Fisher’s research) | Variable | Depends on volatility |

| Complexity | High – requires skill | Low | Moderate |

| Market Suitability | Best in trending or reverting markets | General use | Best in volatile markets |

| Risk Management | Strong – clear entry/exit signals | Trend-following only | Highlights price extremes |

This comparison shows that median lines may demand more effort, but reward traders with greater predictive precision in the right market conditions.

Critical Evaluation and Commentary

While Fisher’s work powerfully supports the method’s validity, it’s vital to view it with contextual awareness:

-

80% accuracy is market- and timeframe-specific (1990–2005, agricultural sector)

-

Subjective line drawing may lead to differing results among traders

-

No testing in modern, algorithm-driven markets—raises questions about current-day performance

Personal insight: Integrating median lines with supporting tools like RSI, MACD, or volume analysis could increase accuracy and reduce subjectivity. Today’s markets demand adaptive strategies, and the median line method—when used in tandem with other techniques—could remain highly effective.

Conclusion: A Legacy Tool with Modern Potential

Using Median Lines as a Trading Tool by Greg Fisher successfully verifies the credibility of Andrews’ median line theory with real-world, historical data. The 80% success rate highlights the tool’s forecasting power—but only when applied consistently and within the right context.

While not a “plug-and-play” indicator, this method rewards those who commit to disciplined technical analysis. In an age dominated by algorithmic trading and complex strategies, the median line stands as a timeless, adaptable technique—one that deserves a place in every serious trader’s toolkit.