Free Download Wolfe Waves by Bill Wolfe – Includes Verified Content:

Wolfe Waves by Bill Wolfe Overview

Wolfe Waves by Bill Wolfe – Mastering the Natural Harmonic Trading Pattern

In the field of technical analysis, traders constantly search for reliable patterns that can help predict future market movements. One of the most intriguing and powerful formations is the Wolfe Wave, discovered and developed by Bill Wolfe. The course “Wolfe Waves by Bill Wolfe” dives deep into this natural and harmonic trading pattern, equipping traders with practical skills to identify, analyze, and trade these setups effectively.

What Are Wolfe Waves?

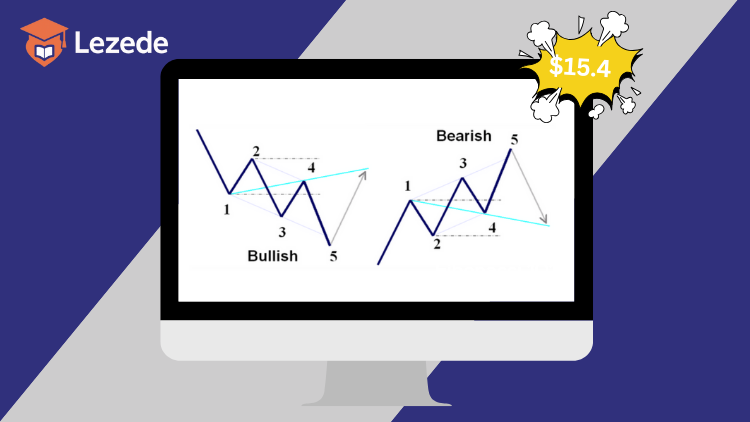

Wolfe Waves are a naturally occurring harmonic trading pattern composed of five distinct waves that represent the ongoing battle between supply and demand. Unlike the Elliott Wave, which relies on complex psychological cycles, Wolfe Waves focus on forecasting breakouts and price targets with remarkable precision.

These patterns typically form within a channel — either parallel or converging — and show a high degree of symmetry. Once identified correctly, Wolfe Waves provide traders with a roadmap of where the market is likely to head, offering potential entry and exit levels with strong risk-to-reward opportunities.

Reversal Properties of Wolfe Waves

The Wolfe Wave is primarily viewed as a reversal pattern:

-

When price action develops within an upward-sloping channel, Wolfe Waves often predict a bearish reversal.

-

Conversely, within a downward-sloping channel, Wolfe Waves typically signal a bullish reversal.

This reversal quality allows traders to anticipate when the market is preparing to change direction, making it a powerful tool for timing entries and exits.

The Psychology Behind Wolfe Waves

Bill Wolfe emphasized that Wolfe Waves are not based on market psychology but rather are natural harmonic occurrences that appear on all financial charts across all time frames. In essence, these waves reflect the underlying equilibrium of supply and demand cycles.

However, many modern traders combine Wolfe Waves with other analytical tools such as volume, support and resistance levels, and price action to gain deeper insight into market sentiment. While Wolfe himself argued the Wolfe Wave stands independently, blending it with other indicators can improve accuracy in real-world trading.

What You Will Learn in Wolfe Waves by Bill Wolfe

The course is designed to give traders both a precise methodology and the right mental attitude for successful trading. Among the key takeaways, you will learn:

-

How to accurately identify Wolfe Waves across multiple time frames, from tick charts to weekly charts.

-

How to determine the Dominant Wave that drives market direction.

-

How to anticipate the rhythm of the market and recognize repeating price cycles.

-

How to pinpoint the “Sweet Zone” — the area with the highest probability trade setups.

-

Scalping strategies using Wolfe Waves for short-term trading opportunities.

-

Volume interpretation and how it interacts with Wolfe Wave formations.

-

The impact of Globex trading on Wolfe Waves and how to adapt.

-

How to approximate wave points in advance, especially the 3-point and 4-point.

-

Real-time case studies, watching S&P Wolfe Waves unfold during the 10 days of intensive instruction.

This comprehensive framework ensures that traders not only learn to spot Wolfe Waves but also gain the confidence to execute trades effectively.

Advantages and Limitations of Wolfe Waves

Advantages:

-

Natural and frequently occurring across all financial markets.

-

Can be applied to any time frame, from intraday to long-term analysis.

-

Provides clear breakout and price target levels.

-

Does not require reliance on multiple indicators.

Limitations:

-

Pattern recognition can be subjective, leading to false setups.

-

Requires practice and experience to master.

-

Can be mistaken for other formations, such as wedges or channels.

Who Should Take This Course?

The Wolfe Waves by Bill Wolfe course is ideal for:

-

Beginner traders who want to learn a simple yet powerful price-based methodology.

-

Experienced traders looking to expand their trading toolkit with harmonic patterns.

-

Traders who want to integrate Wolfe Waves with their current strategies to boost performance.

Tips for Applying Wolfe Waves in Real Trading

-

Always use risk management and protective stop-loss orders.

-

Practice identifying and trading Wolfe Waves on a demo account before going live.

-

Treat Wolfe Waves as a component of a larger trading strategy, not as a standalone system.

-

Stay disciplined, as misidentifying the pattern can lead to poor entries.

Conclusion

The course “Wolfe Waves by Bill Wolfe” offers traders a powerful framework for mastering one of the most natural and reliable harmonic patterns in technical analysis. By understanding the five-wave structure, reversal signals, and sweet zones, traders can better anticipate market moves and improve their decision-making.

While Wolfe Waves require practice to identify consistently, the potential rewards are significant. For traders seeking to enhance their chart reading skills and add a high-probability setup to their arsenal, Wolfe Waves is an invaluable tool.